Will Carbon Markets Evolve in 2022?

Inside this issue

Carbon Markets Set to Evolve in 2022

In December, I published an overview of Emissions Trading & Carbon Investments and a follow-on piece EU ETS From Follower to Leader that described four phases and evolution of the EU ETS.

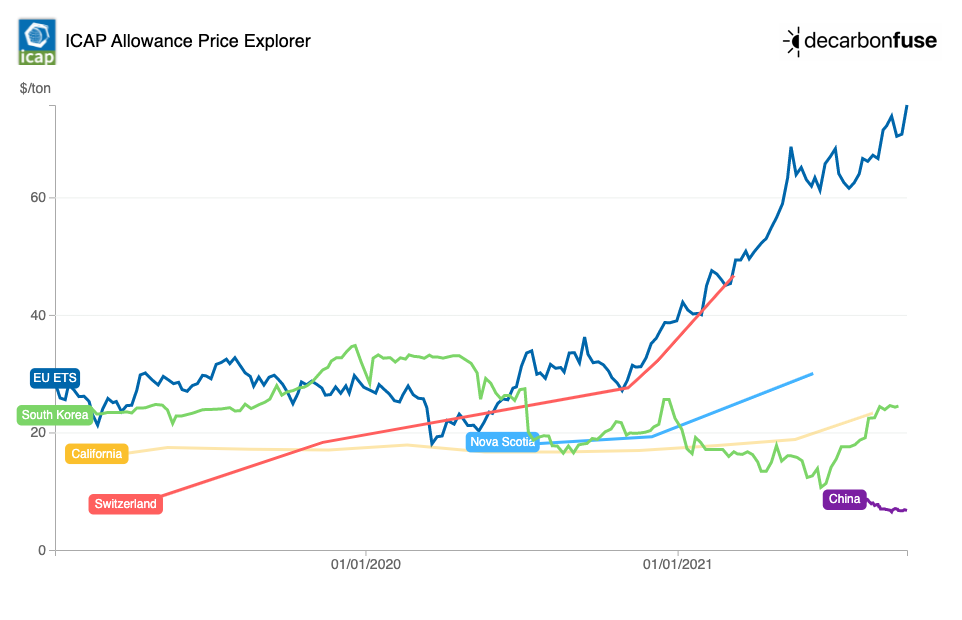

Looking back at carbon prices since 2019, the rise in EU ETS is clear with California and South Korea remaining quite stable over the same period of time. Nova Scotia carbon pricing enters in 2020 and the Chinese ETS pricing begins in 2021.

Switzerland linked the Swiss ETS with the larger EU system to bring more liquidity and transparency to to their trading market. The Switzerland and EU agreement was signed in 2017 and entered into force in 2020. This was the first agreement linking emissions trading systems in the world. Other countries may follow this path as a way to meet sustainability goals while leveraging the maturity and adoption of the EU ETS marketplace.

A long journey for new ETS initiatives?

With new initiatives launching across the world, expect many of the ETS programs to change and evolve from their current state.

The EU ETS evolved over decades and had to resolve several key challenges including:

- Price volatility

- Governance structures

- Monitoring shortcomings

Organizations and countries could adopt supply and demand strategies to ease price volatility and model governance and monitoring after the EU ETS; however, a global uniform approach is likely years away.

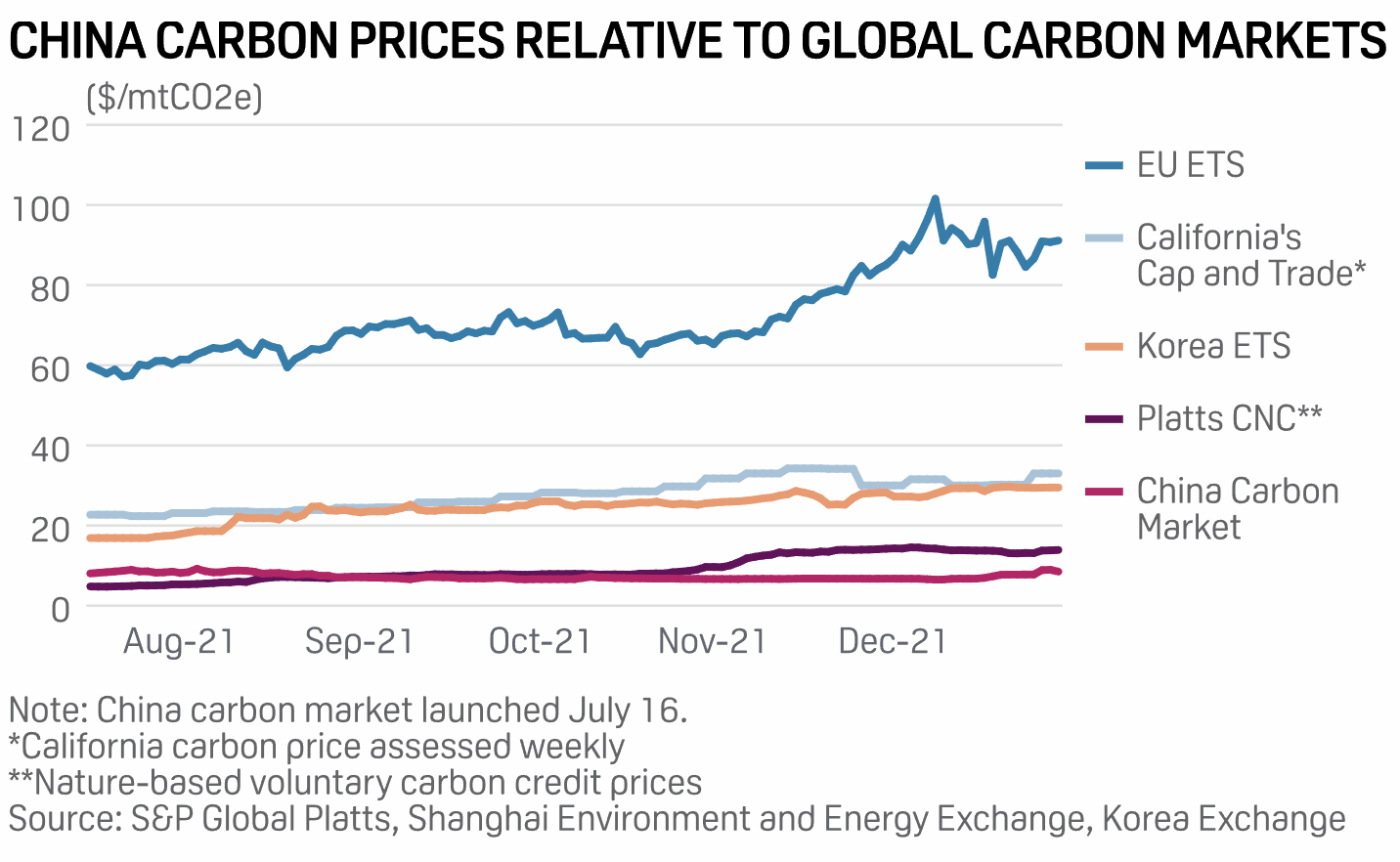

China, potentially the largest carbon trading market, is relaunching voluntary carbon credits and regional pilot programs to entice institutional investors to join the market. China produces more emissions than US and Europe combined based on BP and Bloomberg data.

Power generation accounts for around 40% of China's carbon emissions; 15.2% comes from steel, 13.16% from building materials, 8.16% from refining, petrochemical and chemicals, 1.17% from non-ferrous metals, 0.71% from aviation and 0.65% from paper, according to think tank SinoCarbon's data.

The wider objective is to pave the way for institutional investors to play a role in boosting market size and enhancing carbon market liquidity. China's carbon market has so far been dominated by state-owned companies' bulk transactions to meet emission targets with limited actual trading through listed transactions.

The quote above is in context to China's ETS programs but it applies to all current ETS initiatives underway. Institutional investors and corporate partners must participate to help the development and evolution of ETS programs. Low-carbon and sustainability programs are at the forefront of corporate plans to decarbonize supply chains and industrial processes in 2022 making this year a fascinating one for the evolution of carbon markets.

Inside this Issue

🪨 Navigator C02 Ventures — 2nd of 2 proposed carbon capture pipelines — to hold Story, Boone meetings

📈 Why Prices of EU Carbon Permits are at Record Highs

🌏 Commodities 2022: China's carbon market to expand, build capabilities

🤨 EU Finally Admits Natural Gas And Nuclear Are Key To Decarbonization

✈️ ExxonMobil and Neste collaborate to deliver SAF at French airports

🔥 Texas Geothermal Consortium Launches to Roadmap Capabilities and Technology Gaps

Articles in this issue