IDTechEx Reports on Hydrogen's Decade Ahead: Energizing the Future

Published by Todd Bush on January 15, 2024

BOSTON, Jan. 15, 2024 /PRNewswire/ -- Decarbonization efforts have gained momentum globally in recent years. Renewable energy, electrification, and battery storage are primary solutions. However, some sectors remain difficult to decarbonize using such methods, including heavy industry, heating, and certain transport sectors, such as aviation and shipping. Hydrogen offers a promising solution for these challenging sectors. Its potential as a fuel, energy carrier, and chemical feedstock has led to many governments formulating national hydrogen strategies. Consequently, companies are seizing market opportunities, supplying a range of services, products, and technologies. The burgeoning hydrogen market is drawing attention from stakeholders globally.

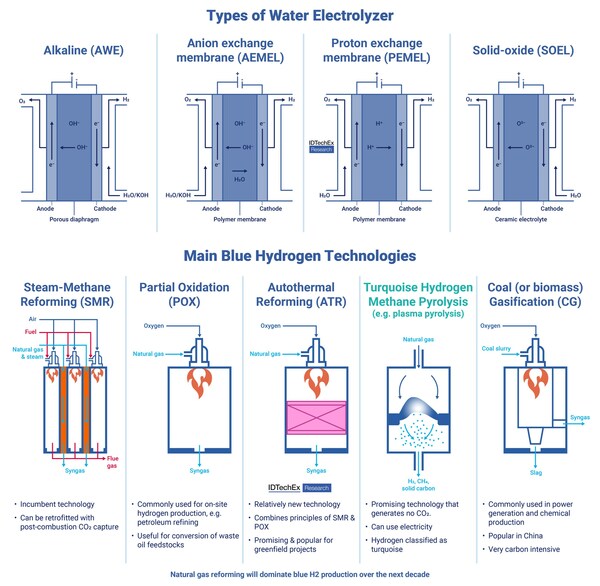

Green & blue hydrogen production technologies. Source: IDTechEx

A cohesive value chain is essential for realizing hydrogen's potential, encompassing low-carbon hydrogen production, storage, and distribution infrastructure, which align with end-user demand. Analogous to the oil & gas sector, the hydrogen value chain comprises upstream (production), midstream (storage & transport), and downstream (end-use) segments. Each segment poses unique technical and socio-economic challenges. IDTechEx's "Hydrogen Economy 2023-2033: Production, Storage, Distribution & Applications" analyzes many of these issues.

Hydrogen economy: Status vs ambition

Currently, over 98% of global hydrogen originates from fossil fuel-based grey and black hydrogen, produced using steam methane reforming and coal gasification. These methods significantly contribute to CO2 emissions. In response, numerous companies are pioneering low-carbon hydrogen production techniques, focusing on blue hydrogen (natural gas reforming with CO2 capture) or green hydrogen (water electrolysis using renewable energy).

The energy transition necessitates new low-carbon hydrogen facilities. Consequently, governments are establishing definitive production goals for upcoming years. For instance, the UK targets 10GW of low-carbon hydrogen by 2030 (2.5 million tonnes of blue H2 annually, 5GW green H2), while the US aims for 10 million tonnes annually. Several other nations also have ambitious production objectives. However, the pace of new production site project announcement and development lags behind these targets due to the high costs of production (especially for green H2), lack of supporting renewable and CCUS infrastructure, long lead times to making final investment decisions, as well as challenges in securing financing and permitting. Coupled with an insufficient midstream storage and distribution network, there is an immense opportunity for development and innovation in both technology and infrastructure across the value chain.

Blue hydrogen production technologies

Currently, blue hydrogen, derived from natural gas, is the most cost-effective low-carbon hydrogen production method, having an estimated levelized cost of hydrogen (LCOH) of around US$2-4/kg H2. In comparison, green hydrogen has a much higher LCOH at US$4-10/kg H2, depending on the production method and regional factors like renewable energy availability. Thus, blue hydrogen is viewed as a transitional solution until green hydrogen becomes commercially viable.

Several technologies can produce blue hydrogen. The most prevalent is steam methane reforming (SMR). Other scalable methods using methane have emerged, such as the partial oxidation (POX) process, which transforms waste hydrocarbon feedstocks into valuable syngas and is used in some refineries globally. Another notable method is autothermal reforming (ATR), a hybrid of SMR and POX.

ATR is favored for its energy efficiency and compatibility with carbon capture technologies, crucial for cost-efficient blue hydrogen production. Noteworthy projects utilizing ATR include Air Products' Net-Zero Hydrogen Energy Complex in Alberta, leveraging Topsoe's SynCOR technology. IDTechEx anticipates SMR, POX, and ATR to lead the blue hydrogen sector in the coming decade, with ATR potentially dominating new production capacity by 2034. More on such topics, as well as novel reforming technologies, such as methane pyrolysis and electrified SMR, is available in IDTechEx's "Blue Hydrogen Production & Markets 2023-2033: Technologies, Forecasts, Players" report.

Green hydrogen production technologies

Green hydrogen, produced through water electrolysis powered by renewable energy, is garnering significant interest. Several technologies exist for its production. The most established is the alkaline water electrolyzer (AWE), which uses a potassium hydroxide (KOH) alkaline electrolyte. Benefiting from affordable construction and catalytic materials like nickel and steel, AWE boasts lower capital costs than its counterparts. Nonetheless, its dynamic operability is poor, and its efficiency is low under atmospheric pressure. Hence, pressurized AWEs have emerged on the market, with most players supplying such systems.

The proton exchange membrane electrolyzer (PEMEL) is the most popular technology as it can integrate extremely well with renewables and follow their profile, ramping production up or down within minutes. This technology has a different build and operating principle to the AWE, using polymer membranes, mainly Nafion, as the electrolyte. The downside is its dependency on platinum group metal (PGM) electrocatalysts, notably iridium oxide at the anode – iridium is a costly and scarce mineral. Consequently, minimizing PGM use and developing alternative catalysts is a key industry focus.

Other technologies include the solid oxide electrolyzer (SOEL), utilizing a ceramic electrolyte, and the anion exchange membrane electrolyzer (AEMEL), which aims to merge the advantages of AWE and PEMEL. However, IDTechEx predicts AWE and PEMEL will lead the market in the coming decade due to their established presence. Cutting electrolyzer plant costs (CAPEX/OPEX), operating large-scale plants, and expanding electrolyzer manufacturing capacity is essential for the future. However, access to affordable renewable electricity will ultimately determine green hydrogen's success. More on such topics, as well as detailed analysis of the electrolyzer market and players, is available in IDTechEx's "Green Hydrogen Production: Electrolyzer Markets 2023-2033" report.

Hydrogen storage & its applications

The development of efficient hydrogen transportation and storage is crucial to maximize hydrogen's potential as an industrial feedstock, fuel, and energy carrier, acting as a bridge between production and consumption. While hydrogen boasts a high gravimetric energy density, its storage and transport present challenges due to its low density at ambient conditions. To improve its volumetric energy density, substantial compression (100-700 bar) or liquefaction at a cryogenic -253°C is required. However, both processes consume significant energy, with compression and liquefaction using 10-30% and 30-40% of the original hydrogen energy, respectively.

Compressed gas and liquid hydrogen tanks are typically used for stationary storage, like at refueling stations. For larger storage at production sites and terminals, liquid hydrogen spheres are preferred. Alternatives, such as metal hydrides, offer lower pressure operation (10-50 bar) and may be more suited for energy storage applications due to their efficiency. However, these systems are yet to be commercialized widely.

Compressed hydrogen tanks, particularly Type III and IV composites, are popular for fuel cell electric vehicles (FCEVs), with models like Hyundai Nexo and Toyota Mirai using Type IV tanks at 700 bar. While compressed storage will remain dominant for light-duty vehicles, liquid hydrogen tanks, with their larger capacity, are explored for heavy-duty sectors, as seen with Daimler Truck.

Underground storage in reservoirs, like salt caverns, is like traditional natural gas storage. Companies like Uniper and Gasunie aim to incorporate these facilities into hydrogen pipelines soon. They are anticipated to play a pivotal role in seasonal storage, supplying the system during demand peaks. Underground facilities may also be used by industrial projects as a buffer reserve of hydrogen – HYBRIT, a sustainable steelmaking project in Sweden, is testing such a concept using a lined rock cavern (LRC). However, regulation and long project development times remain a key challenge for this storage type.

Hydrogen distribution & its applications

Compressed and liquid hydrogen trailers are currently used for small-scale needs like refueling stations or pilot projects. While companies like Hexagon Purus and Chart Industries have developed various types of compressed gas and liquid transport vessels, companies like LIFTE H2 innovate with mobile refuelers to offset the scarcity of hydrogen refueling stations. Such hybrid solutions will be needed in the future hydrogen energy system.

>> In Company Spotlight: Chart Industries

There are about 5,000 km of hydrogen pipelines globally, primarily concentrated in areas like the Gulf Coast in the US and parts of Europe. Managed by industrial gas giants such as Air Products, Linde, and Air Liquide, they mainly supply hydrogen to nearby industrial facilities, like refineries. This confinement emphasizes the pressing need to expand pipeline networks to connect regions of production and consumption more widely, allowing future players to feed and draw H2 from this network. Pipelines may be the most cost-effective solution for large-scale and long-distance transport, so building networks is critical.

>> In Company Spotlight:

New construction is planned, with projects like the HyNet North West Hydrogen Pipeline already underway. Repurposing natural gas pipelines is a possibility but requires extensive simulation, testing, and risk evaluation to identify suitable pipelines. The European Hydrogen Backbone initiative is leading in terms of setting a vision for a large-scale pipeline network, with over 30 operators participating – many of the pipelines are planned to be repurposed from existing networks. Blending hydrogen into natural gas is also a popular concept for partially decarbonizing the heating and power sector, with projects like HyDeploy proving blends of 20 vol% H2 to be safe in existing pipelines. However, higher percentage blends will require modification of many appliances and equipment in residential and industrial sectors.

International long-distance transport may involve liquid hydrogen (LH2) or conversion to hydrogen carriers like ammonia or LOHC. LH2 shipping was demonstrated in the HESC project by Kawasaki Heavy Industries' Suiso Frontier vessel, transporting hydrogen from Australia to Japan. However, this pathway may be unviable compared to hydrogen carriers due to the difficulties of dealing with liquid hydrogen.

The advantage of using hydrogen carriers is the utilization of existing transport routes and vessels, albeit requiring additional processing facilities. Companies like Chiyoda Corporation and H*ydrogenious LOHC Technologies* are commercializing their LOHC solutions. An ammonia receiving terminal is also planned at the Port of Rotterdam. Thus, many companies are seeing ammonia and LOHCs as critical enablers of international hydrogen supply chains. Hence, they are expected to play a substantial role in the future, considering that regions like Europe and Japan may require net imports of hydrogen.

Hydrogen in action: End-use sectors & fuel cells

Hydrogen is expected to significantly decarbonize industries where it is traditionally employed, such as refining, ammonia, and methanol production, by transitioning from grey to blue and green hydrogen. These sectors will account for most of the low-carbon hydrogen demand. Another promising avenue is steelmaking, where hydrogen can produce direct reduced iron (DRI). Major steelmaking companies view this as the future of sustainable steel, anticipating it to replace carbon-intensive blast furnace processes. Additionally, hydrogen is seeing emerging industrial uses in bio- and synfuel production, as well as various power and heat applications, including energy storage, combined heat & power (CHP) generation, and heating across residential and industrial domains. Though currently minor contributors to hydrogen demand, these sectors are forecasted for considerable long-term growth.

Hydrogen also offers an alternative means of power generation for several different sectors, including transportation, back-up power, industry, and utilities. Currently, proton exchange membrane fuel cells (PEMFCs) are the predominant choice for fuel cell installations. Low operating temperatures, small form factor, and high power density, coupled with quick ramp-up times, mean that PEMFCs are particularly well suited to offer an alternative to electrification in the zero-emission transportation sector.

Fuel cell electric vehicles (FCEVs) are gaining traction worldwide, particularly in Asia, with government targets and grants driving the development of refueling infrastructure and new vehicle concepts for light-, medium- and heavy-duty vehicles. The concept of hub-to-hub routes is intriguing for FCEVs, allowing for far greater range than is possible for battery electric vehicles (BEVs). Fuel cell propulsion systems are also eyed by long-haul transport sectors, including marine, rail, and aviation.

However, integrating fuel cell stacks with appropriate hydrogen storage, heat exchangers, and other balance of plant components remains a challenge. Despite their advantages, PEMFCs have limitations, including the need for costly platinum group metal catalysts and ultra-pure hydrogen to prevent catalytic contamination. Consequently, alternative fuel cells like solid oxide fuel cells (SOFCs) are gaining attention.

SOFCs' high operating temperatures allow versatility in fuel choice and eliminate the need for precious metal catalysts. Their thermal exhaust can be harnessed for localized heating (CHP), substantially enhancing fuel cell efficiency. However, these temperatures also cause thermal degradation and lengthy start-up/shut-down times, making SOFCs more suitable for continuous stationary power applications rather than rapid-start back-up power.

Despite the growth in the fuel cell sector, it is worth tempering the hype. IDTechEx forecasts the total accumulative installations (in MW) of SOFCs to be an order of magnitude lower than that for PEMFCs solely in the transportation sector by 2033, while in turn FCEVs will be dwarfed by BEVs over the same period.

For more information on PEMFCs and SOFCs, see IDTechEx's "Materials for PEM Fuel Cells 2023-2033" and "Solid Oxide Fuel Cells 2023-2033: Technology, Applications and Market Forecasts", respectively.

The road ahead for hydrogen

The hydrogen market is increasingly gaining momentum, characterized by rising company involvement, investments, policy support, and broad recognition. Every year sees new technological advancements as companies evaluate diverse options and business models to tap into this emerging market. The sentiment is largely optimistic, with many anticipating robust growth. IDTechEx anticipates that the low-carbon hydrogen market will expand considerably, reaching a valuation of US$130 billion by 2033 based on projected production.

However, there are significant obstacles that the industry must overcome to guarantee hydrogen's place in the sustainable energy future. Coordinating the development of production and transportation infrastructure with end-use sites is crucial, as production initiatives hinge on the creation of off-take agreements. This coordination is vital to sidestep the "chicken-egg" dilemma often discussed in the sector. Fundamentally, there cannot be hydrogen mobility or green steelmaking without established low-carbon hydrogen production, so plants should be built with room for expansion as local hydrogen economies grow.

Another hurdle is reducing the cost and lengthy timelines associated with green hydrogen. These challenges can be addressed by increasing renewable infrastructure development, driving down the price of renewable energy, as well as enhancing electrolyzer technology, and scaling up its manufacturing to the GW level. Additionally, government incentives, such as tax breaks, grants, and loans, will be pivotal for funding capital-intensive hydrogen projects. Expedited permitting procedures, especially for blue hydrogen's CCUS infrastructure and refueling stations, are essential for maintaining project schedules.

There are also many broader macroeconomic challenges. These encompass sourcing project finance in a decelerating global economy, standardizing low-carbon hydrogen definitions worldwide, and devising financial and tracking mechanisms for hydrogen. As hydrogen is not yet commoditized, establishing robust financial systems will be key to the hydrogen economy's success.

Please see IDTechEx's report "Hydrogen Economy 2023-2033: Production, Storage, Distribution & Applications" for more discussion on the technologies, commercial activity, as well as industry challenges and opportunities. For further research on hydrogen please visit www.IDTechEx.com/Research/Energy. IDTechEx offer access to the full portfolio of energy related research through bespoke subscription services – visit www.IDTechEx.com/Energy to find out more.

This article is from "Technology Innovations Outlook 2024-2034", a complimentary magazine of analyst-written articles by IDTechEx providing insights into a number of areas of technology innovation, assessing the landscape now and giving you the outlook for the next decade. You can read the magazine in full at www.IDTechEx.com/Magazine.

About IDTechEx

IDTechEx guides your strategic business decisions through its Research, Subscription and Consultancy products, helping you profit from emerging technologies. For more information, contact [email protected] or visit www.IDTechEx.com.

SOURCE IDTechEx

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Companies

Latest issues

-

How Direct Air Capture Could Drop 75% in Cost

Inside This Issue 💨 How Direct Air Capture Could Drop 75% in Cost ⚡ Cache Power Advances 30 GWh Compressed Air Energy Storage Project In Alberta 🪨 Canada Nickel And The University Of Texas At Aust...

-

EPA Rule Unlocks $20B Biofuels Boom: The Decarbonization Players Who Gain

Inside This Issue 🌾 EPA Rule Unlocks $20B Biofuels Boom: The Decarbonization Players Who Gain ⛏️ DMS Georgia: World’s First Deep Mine Carbon Storage 💧 Dirty Water Boosts Prospects for Clean Hydrog...

-

Inside the Power Plant Conversion Everyone’s Arguing About

Inside This Issue ⚡ In Controversial Move, LADWP Says It Will Shift Its Largest Gas Power Plant to Hydrogen 🌎 NorthX Catalyzes the Rise of Canada's Carbon Removal Industry 🤝 Elemental Clean Fuels ...

Company Announcements

-

CHAR Tech Invited To Join The Canadian Iron & Steel Energy Research Association (CISERA)

TORONTO, Oct. 29, 2025 (GLOBE NEWSWIRE) -- CHAR Technologies Ltd. ("CHAR Tech" or the "Company") (TSXV:YES), a leader in sustainable energy solutions, is pleased to announce that it has been invite...

-

Scientists May Have Found a Near-Limitless Energy Source That Could Power Earth Forever

The Midcontinent Rift is an ancient crack in the ground that started to open across the middle of North America about 1.1 billion years ago. Over time, this rift became home to magma, water, metals...

-

ICAO General Assembly 2025 Reaffirms Aviation’s Commitment to Net-Zero by 205

The 42nd International Civil Aviation Organization (ICAO) General Assembly, held in Montreal in October 2025, made waves with pivotal decisions concerning the future of aviation sustainability. As ...

-

University of Alberta-led research highlights emerging hydrogen storage potential at Robinsons River Salt Dome November 04, 2025 08:00 ET | Source: Vortex Energy Corp. VANCOUVER, British Columbia...