The Producer Imperative - Reduce CO2 & Methane Emissions

Inside this issue

Reducing Emissions from O&G Operations

Each quarter the Federal Reserve Bank of Dallas conducts the Energy Survey to understand the challenges and economic conditions of the Eleventh District energy firms. Last weekend, the Dallas Fed quietly published the results of the Q4'21 survey that included 134 energy firms, 90 exploration & production and 44 oilfield services firms.

The Dallas Fed considers large E&Ps as firms producing more than 10,000 barrels/day ("b/d") and small firms producing less than 10,000 b/d.

The survey poised several interesting special questions for the quarter:

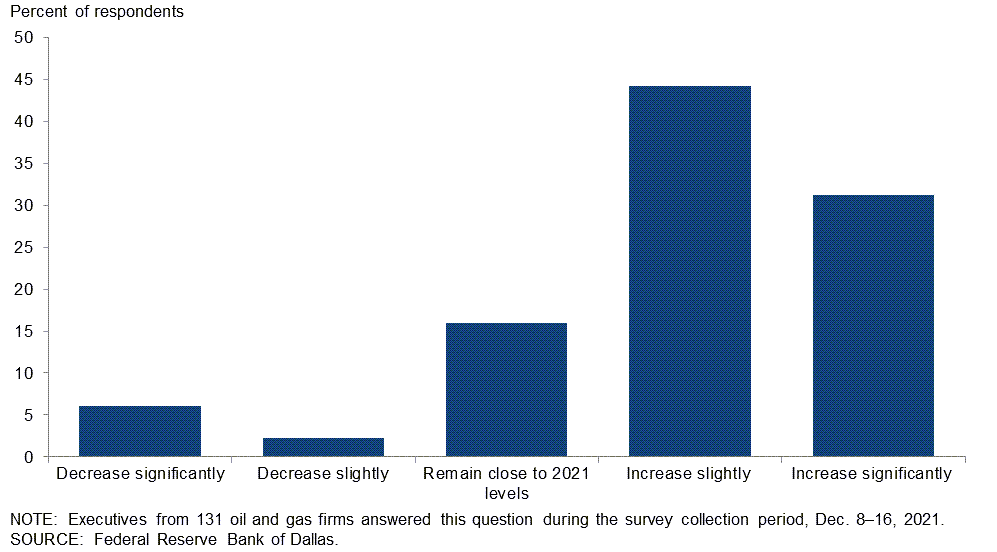

What are your expectations for your firm's capital spending in 2022 versus 2021? 78% of E&Ps responded increase slightly or increase significantly

Do you believe countries will be able to meet their commitments for 2030 for reducing greenhouse gas emissions? 95% of the companies believe that countries will not be able to meet their 2030 commitments

Which of the following (emission reduction) plans does your firm have? For large E&Ps, 63% plan to reduce CO2 emissions and 68% plan to reduce methane emissions. However, smaller firms are much less likely with only 21% planning to reduce CO2 emissions and 24% planning to reduce methane emissions.

By how much do you expect your firm to reduce greenhouse gas emissions from 2020 to 2025 in terms of barrel-of-oil equivalent produced? Nearly 40% of large E&Ps expect to reduce greenhouse gas emissions by more than 10%.

Comments from the special section highlight the emphasis for clean energy:

We issued the industry’s first sustainability-linked bonds in conjunction with our commitment to reduce GHG emissions by 50 percent over the next five years.

We are hedging our portfolio with a nod to invest in solar and tree farms. It is not a significant portion of our budget but is a learning opportunity.

What are your expectations for your firm's capital spending in 2022 versus 2021?

For all companies, about 131 responses, the majority of executives expect capital spending to increase in 2022.

Executive Capital Spending Expectations for 2022

The capital, in most cases, will come from the company's cash flow not external sources. Availability of capital continues to be a challenge for large and small E&P firms.

The political pressure forcing available capital away from the energy industry is a problem for everyone. Banks view lending to the energy industry as having a “political risk.” The capital availability has moved down-market to family offices, etc., and it is drastically reducing the size and availability of commitments regardless of commodity prices.

Inside this Issue

💰 S&P Global Acquires The Climate Service, Inc

🌲 Clean Tech Startup Mote Unveils Plans for $100M Carbon Capture Plant

🚀 Bill Gates-founded Clean-tech Initiative Funds Rocket Startup

♻️ US-based Cummins to build 1GW hydrogen electrolyser factory in China with state-owned oil giant Sinopec

🌍 Clean Hydrogen Partnership vital to EU climate goals

🔌 Tesla Supercharger network is now ‘officially’ in all 50 states with public Hawaii station

Articles in this issue