The decarbonization landscape is shifting dramatically as carbon capture and storage (CCS) policies gain unprecedented momentum worldwide. The Global CCS Institute's latest mid-year analysis reveals a complex regulatory tapestry emerging across continents, while the maritime industry faces its first-ever global emissions framework that could reshape shipping forever.

What started as scattered pilot projects has evolved into a coordinated international push. From Europe's ambitious funding packages to Asia's new carbon exchanges, governments are finally moving beyond climate pledges to create actionable regulatory frameworks that companies can build upon.

>> RELATED: Clean Fuels, Clear Skies: How Maritime Shipping Is Turning to Hydrogen, Ammonia, and Carbon Capture

Europe Sets the Regulatory Pace

“Carbon capture and storage is no longer a theoretical solution—it is becoming an essential, scalable technology backed by strong policy frameworks worldwide. The coordinated regulatory momentum, especially in Europe and Asia, is finally creating the conditions for commercial deployment at the gigaton scale.”

Dr. Jennifer Wilcox, Professor of Chemical Engineering, University of Pennsylvania (2025)

European policymakers have emerged as clear frontrunners in CCS regulation during the first half of 2025. The continent introduced comprehensive frameworks including the Carbon Removals and Carbon Farming Regulation alongside substantial funding through the Clean Industrial Deal. These moves signal Europe's commitment to transforming CCS from experimental technology into commercial reality.

The regulatory momentum extends beyond traditional environmental policies. European officials are now integrating CCS requirements into industrial planning, creating a foundation for long-term investment confidence that the industry has desperately needed.

Key CCS Development Highlights

- 65 operational facilities globally with capacity to capture 57 million tonnes of CO2 annually

- 42 facilities under construction will add another 44 million tonnes of capacity

- Brazil launched its regulated carbon market (SBCE) platform

- Indonesia debuted a national carbon exchange system

- Japan identified its first offshore CCS storage zone

U.S. States Drive Forward Despite Federal Uncertainty

While federal IRA disbursements faced temporary delays, American state governments refused to wait for Washington's direction. Wyoming, Arkansas, and Utah have pushed ahead with Class VI well primacy programs and long-term CO2 storage oversight frameworks. This state-level initiative demonstrates how climate technology deployment continues regardless of political headwinds.

Image source: Policy, Legal and Regulatory Review: Mid-2025 Update and Perspective on the IMO’s Net Zero Framework

The decentralized approach may actually accelerate CCS adoption by allowing states to tailor regulations to their specific geological and economic conditions. Regional expertise is proving more valuable than one-size-fits-all federal mandates.

Asia and Middle East Join the Race

Asian markets are rapidly developing their own CCS infrastructure and regulatory frameworks. China's ministries issued comprehensive multi-sector CCS guidance, while Indonesia and Brazil launched carbon trading platforms that connect local projects to international markets. These developments create new opportunities for cross-border collaboration and technology transfer.

The Middle East is positioning itself as a CCS leader through practical demonstration projects. ADNOC received the region's first CO2 storage certification, while Qatar announced an ambitious 37-million-tonne CO2 reduction plan by 2030. These commitments from major oil producers signal a fundamental shift in how energy companies view their role in climate solutions.

Maritime Industry Faces Historic Transformation

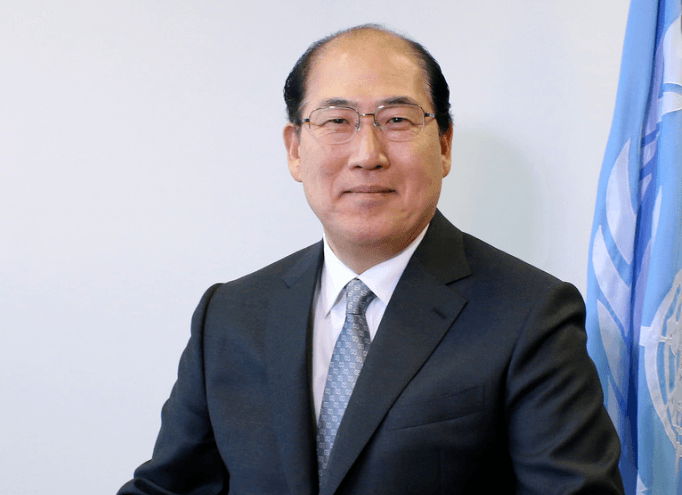

“The adoption of the IMO’s Net-Zero Framework marks an historic milestone for global shipping. By setting clear carbon limits and establishing a market-driven trading system, we are ensuring that maritime transport plays its full part in achieving the Paris Agreement targets.”

Kitack Lim, Secretary-General of the International Maritime Organization (IMO)

The International Maritime Organization (IMO) delivered a bombshell in April 2025 with its legally binding Net-Zero Framework. This represents the first global emissions regime designed specifically for an entire industry sector, targeting a 70-80% reduction in maritime greenhouse gas emissions by 2040 on the path to net-zero by 2050.

Figure 1 – Source: Gard (Henderson, 2025)

The framework introduces several game-changing elements. Ships exceeding emission thresholds must purchase offset credits at prices reaching $380 per tonne CO2e, while efficient vessels can sell surplus units. This creates immediate financial incentives for clean technology adoption rather than waiting for voluntary industry action.

IMO Net-Zero Framework Components

- Global Fuel Intensity (GFI) standard for ships over 5,000 gross tonnage

- Carbon pricing mechanism starting at $100 per tonne CO2 in 2028

- Trading system allowing efficient ships to sell surplus credits

- Net-Zero Fund expected to raise $11-13 billion annually

- Full implementation scheduled for 2027

Technology Companies Rush to Meet Demand

Forward-thinking companies are already positioning themselves for the coming regulatory wave. Projects like EverLoNG and REMARCCABLE are piloting onboard carbon capture systems (OCCS) that could help ships meet the new emission standards. Ports worldwide are scrambling to develop infrastructure for alternative fuels and carbon capture integration.

The $11-13 billion annual Net-Zero Fund creates a massive market opportunity for clean technology developers. Companies that establish early footholds in maritime decarbonization could capture significant market share as the entire industry transforms over the next decade.

Investment flows are already shifting toward companies with credible decarbonization solutions. Early movers may secure both operational advantages and preferential financing as lenders increasingly factor climate regulations into their risk assessments.

Cross-Border Collaboration Emerges

Perhaps the most significant development is the emergence of coordinated international frameworks that enable cross-border CO2 transport and storage. Countries are recognizing that effective climate action requires integrated infrastructure that transcends national boundaries. This shift from competitive to collaborative approaches could accelerate deployment timelines significantly.

The regulatory convergence also reduces compliance complexity for multinational companies. Rather than navigating dozens of conflicting national standards, businesses can now work within increasingly harmonized international frameworks that provide clearer investment signals.

Industry Momentum Builds

The convergence of supportive policies, technological advances, and market demand is creating unprecedented momentum for both CCS deployment and maritime decarbonization. Companies that adapt quickly to these new regulatory realities will likely capture disproportionate benefits as entire industries restructure around climate requirements.

The Global CCS Institute's analysis demonstrates that decarbonization has moved from aspirational goal to operational requirement. With clear regulatory frameworks now in place across multiple continents, the question is no longer whether these technologies will scale, but how quickly companies can execute their deployment strategies.

The maritime sector's transformation represents just the beginning of industry-wide regulatory shifts. As governments gain confidence in designing effective climate policies, expect similar comprehensive frameworks to emerge across other high-emission sectors in the coming years.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

This $4.1M Deal Could Change Carbon Capture's Playbook

Inside This Issue 🗜️ CarbonQuest Lands $4.1M Alberta Deal on Gas Compressors 🛡️ CADO, 123Carbon, and Assure SAF Registry Join Forces to Tackle SAF Integrity Gaps ✈️ ISCC, OMV, and Airbus Partner t...

-

Can Koloma Crack Iowa's Billion-Year-Old Secret?

Inside This Issue ⛏️ Iowa's Hydrogen Rush: Can Koloma Strike Gold Before Rules Kick In? ✈️ Bentley Commits to Use 100% Sustainable Aviation Fuel for Car Airfreight 🌬️ Minister Parrott Provides Upd...

-

$47M Just Poured Into This SAF Producer

Inside This Issue 💰 LanzaJet Announces $47M in New Capital and First Close of Equity Round at $650M Pre-Money Valuation 🚢 Maersk's Ethanol Bet Could Reshape U.S. Fuel Markets 🪨 Canada Nickel and t...

Company Announcements

-

RCJY and Climeworks Deepen Partnership to Advance Large-scale Direct Air Capture in Saudi Arabia

Key takeaways: Under the guidance of the Ministry of Energy, the Royal Commission for Jubail and Yanbu and Climeworks have signed a Memorandum of Understanding to expand their collaboration on de...

-

CHARBONE Confirms New UHP Hydrogen Orders and its First UHP Oxygen Order in the United States

Brossard, Quebec, February 25, 2026 – CHARBONE CORPORATION (TSXV: CH; OTCQB: CHHYF; FSE: K47) (“CHARBONE” or the “Company”), a North American producer and distributor specializing in clean Ultra Hi...

-

Climeworks Establishes Canadian Headquarters in Calgary

Calgary, Alberta, February 20, 2026 — Climeworks, a global leader in commercial carbon removal, has established its Canadian headquarters at Calgary’s ETC, one of Alberta’s leading hubs where start...

-

MIAMI, Feb. 24, 2026 /CNW/ - Power Sustainable Infrastructure Credit ("PSIC") recently closed an $85M senior secured financing for Sagepoint Energy ("Sagepoint"), a vertically integrated renewable ...