EIA: US Biodiesel And Renewable Diesel Imports Fall Sharply In 2025 After Tax Credit Change

Published by Todd Bush on September 5, 2025

September 5, 2025BY U.S. Energy Information Administration

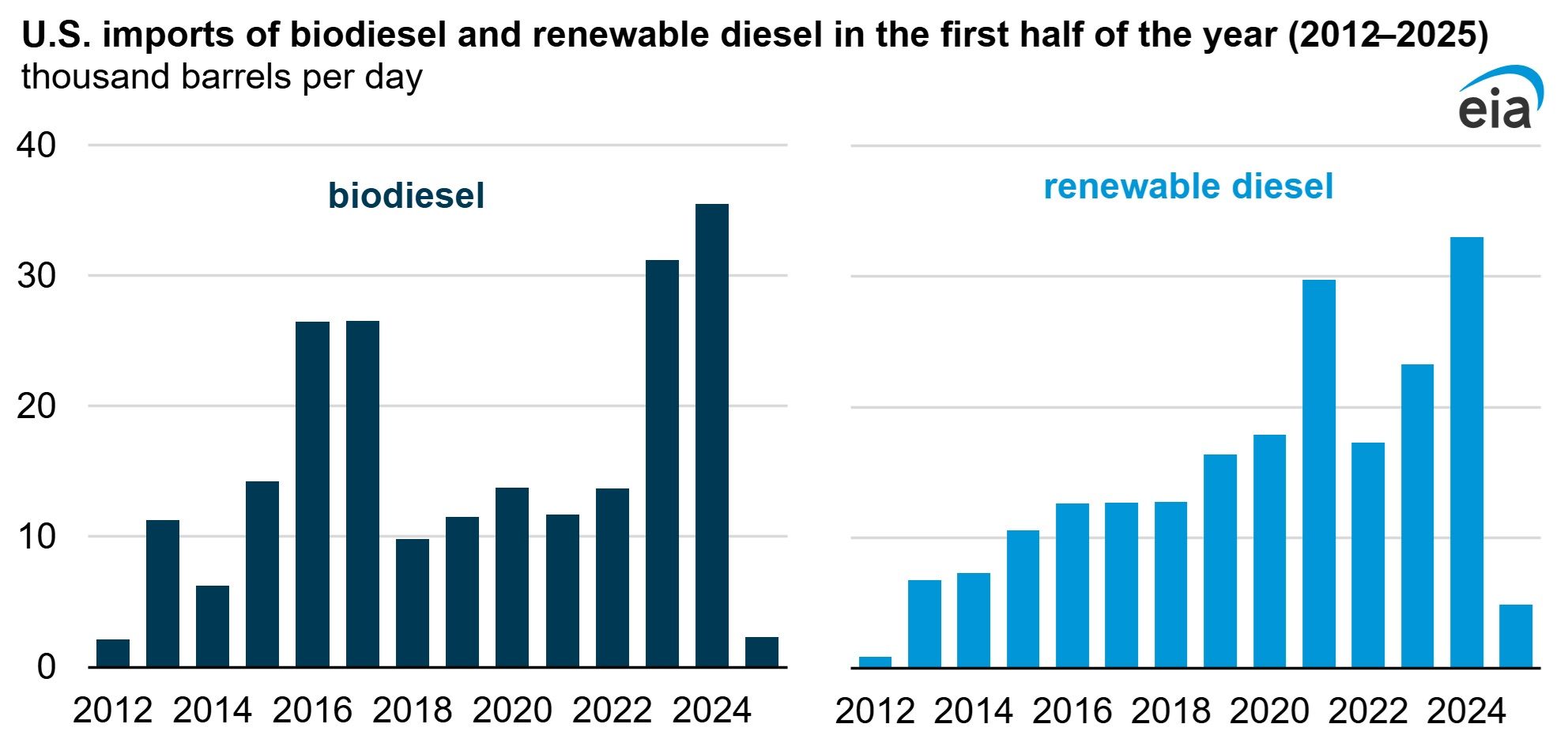

U.S. imports of biodiesel and renewable diesel significantly decreased in the first half of 2025 (1H25) compared with the same period in previous years. This decline is primarily due to the loss of tax credits for imported biofuels and generally lower domestic consumption of these fuels.

Renewable diesel and biodiesel are biomass-based diesel fuels that can replace petroleum-based distillate and be used to comply with the Renewable Fuel Standard blending requirements for refiners administered by the U.S. Environmental Protection Agency.

Data source: U.S. Energy Information Administration, Petroleum Supply Monthly Note: Consumption is defined as product supplied plus refinery and blender net inputs.

>> In Other News: US SAF Production Hits Critical 30,000 BPD Milestone

In 1H25, U.S. biodiesel imports averaged 2,000 barrels per day (b/d), a sharp drop from 35,000 b/d in 1H24. Renewable diesel imports averaged 5,000 b/d, down from 33,000 b/d in 1H24. These import levels were the lowest for the first half of any year since 2012, when U.S. biodiesel consumption was less than half of 2024 levels and renewable diesel consumption was negligible.

One key reason for the sharp drop in biodiesel and renewable diesel imports in early 2025 is the loss in tax credits for imported biofuels. Before 2025, both imported and domestically produced biodiesel and renewable diesel received a $1 per gallon blender’s tax credit (BTC). The Inflation Reduction Act replaced the BTC with the Section 45Z Clean Fuel Production Credit in 2025, which only applies to domestic production. This tax credit change placed imports at a relative economic disadvantage.

A second reason biodiesel and renewable diesel imports dropped in 1H25 was low U.S. consumption of these fuels because of uncertainty around blending requirements and negative profit margins for blending biofuels. Compared with 1H24, U.S. consumption of renewable diesel was down about 30% in 1H25, and biodiesel consumption was down about 40%. This lower consumption reduced demand for both imported and domestically produced biofuels.

The combination of poor blending margins and the relative economic disadvantage for imported biofuels led domestic blenders to rely on domestically produced biofuels for the smaller amounts they were blending. As a result, international biofuel producers found fewer profitable opportunities to send product to the United States. For example, Neste, the producer of all of the renewable diesel imported to the United States, reported a lower share of exports going to the United States in 1H25 than in 1H24. Looking ahead, we expect U.S. consumption of biodiesel and renewable diesel to increase as the year progresses to meet existing RFS mandates, but imports of the fuels will likely remain low because of the change in tax policy.

Although we do not explicitly forecast biodiesel and renewable diesel imports in the Short-Term Energy Outlook, we do forecast U.S. net imports. We assume low imports for both products in the forecast period and forecast U.S. biodiesel net imports in 2025 and 2026 to be their lowest since 2012.

About U.S. Energy Information Administration

The U.S. Energy Information Administration (EIA) collects, analyzes, and disseminates independent and impartial energy information to promote sound policymaking, efficient markets, and public understanding of energy and its interaction with the economy and the environment.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

This $4.1M Deal Could Change Carbon Capture's Playbook

Inside This Issue 🗜️ CarbonQuest Lands $4.1M Alberta Deal on Gas Compressors 🛡️ CADO, 123Carbon, and Assure SAF Registry Join Forces to Tackle SAF Integrity Gaps ✈️ ISCC, OMV, and Airbus Partner t...

-

Can Koloma Crack Iowa's Billion-Year-Old Secret?

Inside This Issue ⛏️ Iowa's Hydrogen Rush: Can Koloma Strike Gold Before Rules Kick In? ✈️ Bentley Commits to Use 100% Sustainable Aviation Fuel for Car Airfreight 🌬️ Minister Parrott Provides Upd...

-

$47M Just Poured Into This SAF Producer

Inside This Issue 💰 LanzaJet Announces $47M in New Capital and First Close of Equity Round at $650M Pre-Money Valuation 🚢 Maersk's Ethanol Bet Could Reshape U.S. Fuel Markets 🪨 Canada Nickel and t...

Company Announcements

-

RCJY and Climeworks Deepen Partnership to Advance Large-scale Direct Air Capture in Saudi Arabia

Key takeaways: Under the guidance of the Ministry of Energy, the Royal Commission for Jubail and Yanbu and Climeworks have signed a Memorandum of Understanding to expand their collaboration on de...

-

CHARBONE Confirms New UHP Hydrogen Orders and its First UHP Oxygen Order in the United States

Brossard, Quebec, February 25, 2026 – CHARBONE CORPORATION (TSXV: CH; OTCQB: CHHYF; FSE: K47) (“CHARBONE” or the “Company”), a North American producer and distributor specializing in clean Ultra Hi...

-

Climeworks Establishes Canadian Headquarters in Calgary

Calgary, Alberta, February 20, 2026 — Climeworks, a global leader in commercial carbon removal, has established its Canadian headquarters at Calgary’s ETC, one of Alberta’s leading hubs where start...

-

MIAMI, Feb. 24, 2026 /CNW/ - Power Sustainable Infrastructure Credit ("PSIC") recently closed an $85M senior secured financing for Sagepoint Energy ("Sagepoint"), a vertically integrated renewable ...