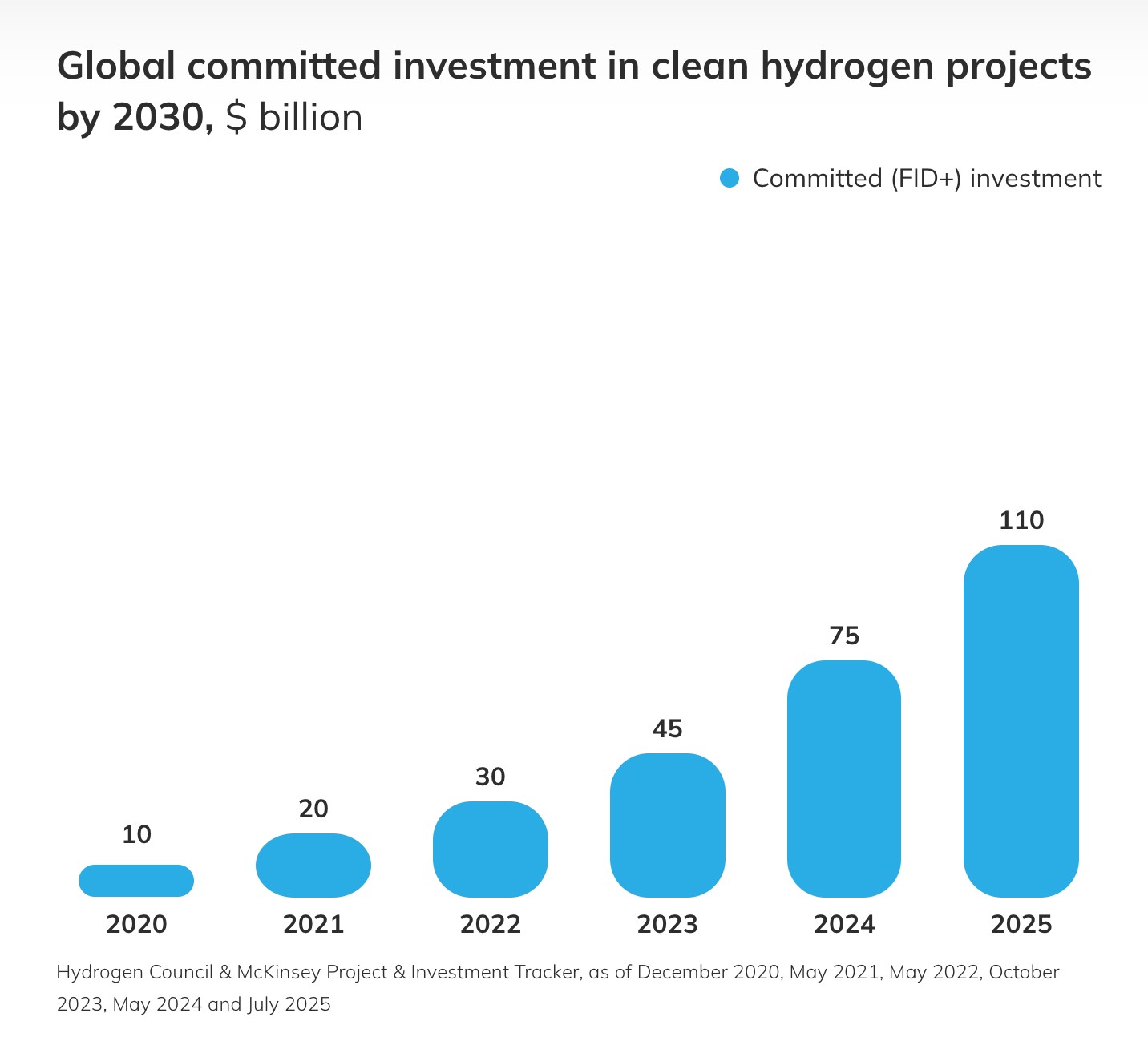

Global hydrogen investment has topped $110 billion, up $35 billion from last year, with total committed capacity exceeding 6 million tons (metric tons) per year (mtpa), says the Hydrogen Council.

The global hydrogen industry has surpassed $110 billion in investments, according to the Hydrogen Council.

The figure marks a $35 billion increase from last year. Since 2020, the global hydrogen sector has averaged a 50% year-on-year growth rate in committed investments.

Image: Hydrogen Council

>> In Other News: Hanwha Power Systems Receives Approval in Principle From ABS for 174k LNG Carrier Ammonia Fuel Gas Turbine Retrofit

The council’s inaugural Global Hydrogen Compass report identified 510 projects worldwide that are past final investment decisions, under construction, or operational. Since 2020, more than 1,700 projects have been announced, equal to a 7.5-fold increase.

China leads with $33 billion in committed investments, followed by North America with $23 billion and Europe with $19 billion. India has invested $14 billion, while the Middle East has invested $11 billion. Japan and South Korea together account for $6 billion, South America for $2 billion and Oceania for $1 billion.

Total committed capacity now exceeds 6 million mtpa, including 1 mtpa already in operation. The council said the current pipeline could support 9 mtpa to 14 mtpa of clean hydrogen by 2030, but demand must materialize.

The Hydrogen Council said locking in offtake remains critical for most supply projects. About 3.6 mtpa of binding offtake has been secured to date, equal to 60% of committed project capacity. The council forecast up to 8 mtpa could materialize by 2030 in the European Union, United States, Japan and South Korea, but stressed that will require full implementation and enforcement of existing policies.

Roughly 50 projects have been publicly canceled in the past 18 months, equal to about 3% of the total pipeline. Most were early-stage ventures that failed due to high interest rates and delayed policy measures. The council’s analysis said projects with stronger business cases are advancing, while weaker ones are being withdrawn, reflecting a maturing industry.

Sanjiv Lamba, Hydrogen Council co-chair, claimed that the global hydrogen sector is at a “pivotal juncture.”

“Accelerating market creation and securing binding offtake agreements must become the priority to ensure today’s projects deliver real impact,” Lamba said. “Achieving this will require stronger collaboration between business and government to build the frameworks and partnerships essential for progress.”

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

What Do Submarines Have to Do With Hydrogen?

Inside This Issue 🚢 Hyundai Pitches Hydrogen Transport Tied To Canada Submarine Bid 🧱 The LEGO Group Expands Its Portfolio Of Carbon Removal Solutions 🏆 SAF Pioneer LanzaJet Honored With RFA Indus...

-

This $4.1M Deal Could Change Carbon Capture's Playbook

Inside This Issue 🗜️ CarbonQuest Lands $4.1M Alberta Deal on Gas Compressors 🛡️ CADO, 123Carbon, and Assure SAF Registry Join Forces to Tackle SAF Integrity Gaps ✈️ ISCC, OMV, and Airbus Partner t...

-

Can Koloma Crack Iowa's Billion-Year-Old Secret?

Inside This Issue ⛏️ Iowa's Hydrogen Rush: Can Koloma Strike Gold Before Rules Kick In? ✈️ Bentley Commits to Use 100% Sustainable Aviation Fuel for Car Airfreight 🌬️ Minister Parrott Provides Upd...

Company Announcements

-

CHIFENG, China, Feb. 27, 2026 /PRNewswire/ -- Envision Energy launched the first global shipment of green ammonia from Chifeng, Inner Mongolia to LOTTE Fine Chemical, a premier chemical company in ...

-

SAF Pioneer LanzaJet Honored With RFA Industry Award

Pioneering sustainable aviation fuel producer LanzaJet received the Renewable Fuels Association’s 2026 Industry Award at the National Ethanol Conference in Orlando this week. Last year the company ...

-

Houston Hosts World Hydrogen North America 2026 Industry Gathering

Hydrogen is one of the energy sources that has evolved the most when it comes to how developers plan and execute projects. The main reason for this is the advanced technology that has penetrated th...

-

Trump EPA Eyes Reallocating Waived Biofuel Obligations To Refiners: Report

The question of whether to reallocate those exempted blending obligations to larger refiners is a point of contention between the agriculture and fuel industries The Trump administration has settl...