Hammerhead Resources Inc. and Decarbonization Plus Acquisition Corporation IV Announce C$1.39 billion Business Combination; Combined Company to be Listed on Nasdaq

Published by Todd Bush on September 26, 2022

- Transaction to form a publicly traded upstream oil and gas company with a path toward achieving net zero emissions on a Scope 1 and Scope 2 basis by 2030

- Combined company to advance its differentiated carbon capture and sequestration ("CCS") program in an effort to create value for all stakeholders

- Hammerhead's CCS program is estimated to require approximately C$240 million1 of capital between 2023 and 2029, and, by 2029, is expected to reduce Hammerhead's Scope 1 and Scope 2 emissions by approximately 79% of 2021 levels, even after an anticipated doubling of production volumes

- Combined company's assets to include a large consolidated block of acreage in the prolific Montney trend in Western Canada, spanning over 110,000 net acres in Alberta, the assembly and development of which is the result of over C$1.19 billion of primary equity raised by Hammerhead since its founding in 2009

- Hammerhead's 2P PV10 value was approximately C$2.5 billion based on the reserve evaluator's price deck at December 31, 20212 and C$4.1 billion based on strip pricing at September 9, 2022

- With an identified drilling inventory of over 1,500 locations and an anticipated on-stream count averaging around 30 wells per year, Hammerhead boasts an attractive multi-decade inventory of potential high-return locations in a top-performing onshore basin

- DCRD expects Hammerhead's planned production and EBITDA growth to be in excess of 40% and 50%, respectively, from 2022 projected levels of 31,500-32,500 boe/d and C$375-425 million to an expected 46,000-48,000 boe/d and C$625-675 million in 20243

- The closing of the transaction is not subject to a minimum cash condition; the parties believe that Hammerhead's existing balance sheet with expected leverage, prior to any proceeds from DCRD's cash in trust, of 0.6x LTM EBITDA at year-end 2022, will provide the liquidity necessary to execute on Hammerhead's business plan

- The transaction values Hammerhead at approximately 2.2x DCRD's projected 2024 EBITDA for Hammerhead

MENLO PARK, Calif. and CALGARY, AB, Sept. 26, 2022 /PRNewswire/ -- Hammerhead Resources Inc., a Calgary-based energy company ("Hammerhead"), and Decarbonization Plus Acquisition Corporation IV (Nasdaq: DCRD, DCRDW, DCRDU), a special purpose acquisition company ("DCRD"), announced today that they have entered into a definitive agreement for a business combination that values Hammerhead at C$1.39 billion. Upon closing of the transaction, the combined company is expected to be listed on the Nasdaq Capital Market ("Nasdaq") and trade under the ticker symbol "HHRS". Closing of the transaction is expected to occur in Q1 2023. The combined company will continue to be managed by Hammerhead's current executive team, led by CEO Scott Sobie.

>> In Other News: Overcoming Supply Chain Challenges Key to Energy Transition – EIC Connect

"We are extraordinarily proud of the company we have built since inception over a decade ago," said Scott Sobie. "Not only does Hammerhead stand poised to harvest what we consider to be among the most attractive rates of return well locations in Western Canada, but Hammerhead's current emissions profile is already advantaged through its investment of over C$400 million in modern, technically optimized facilities that are being utilized across its properties. We believe an energy transformation is underway where conventional energy and power sources will continue to play an important role in the world energy mix for some time to come. The current global profile of both energy security and resource intermittency are demonstrating the need for continued reliance on conventional sources. We believe the energy industry has an emissions challenge, and we aim to be a leader in redefining public expectations around how companies like ours can contribute to the advancement of global net zero goals."

Hammerhead's asset base on June 30, 2022 comprised approximately 111,000 net acres and 146 gross producing wells within the light oil window of the Alberta Montney. The Montney has ranked among the most attractive plays in North America with respect to well returns and capital efficiency. Hammerhead has an extensive undeveloped inventory of over 1,500 gross well locations targeting the Upper and Lower Montney within its core development areas of Gold Creek, South Karr, and North Karr. The development program planned for the next four years consists of locations that are expected to generate well-level economics of 100-230+% IRRs at a long-term planning price deck of $80 WTI and $4.50 NYMEX. With a planned development cadence through 2026 of an average of approximately 30 wells onstream per year, Hammerhead has a multi-decade inventory of high-quality locations. The Upper Montney represents a stacked lateral resource play where we believe that Hammerhead has delivered compelling results through pad drilling across multiple benches. Recently, Hammerhead observed strong performance in the Lower Montney bench via production tests, which Hammerhead believes is further validated through neighboring peer drilling activity.

Hammerhead expects its 2022 production to average 31,500-32,500 boe/d (approximately 42% liquids). At December 31, 2021, Hammerhead had proved developed producing and total proved plus probable ("2P") reserves of approximately 51 mmboe and approximately 310 mmboe, respectively, with 276 booked 2P locations and a 2P PV10 value of approximately C$2.5 billion based on the reserve evaluator's price deck at December 31, 2021. Hammerhead also enjoys the benefit of several years of marketing strategy development and execution for its natural gas production. In 2016, Hammerhead initiated a gas contracting strategy that by 2021 resulted in moving over 60% of gas sales from the AECO hub price index for Alberta natural gas to significantly more profitable firm egress contracts at Chicago, Dawn, Malin and Stanfield. Once Canadian liquified natural gas has materialized, Hammerhead believes that its resource base will be well positioned to serve global markets with low-carbon hydrocarbons as the global economy reduces its carbon footprint.

Hammerhead intends to deliver substantial production and cash flow growth over the next several years. Hammerhead expects to achieve this growth profile while targeting free cash flow neutrality in 2023, driven by already realized drilling and completion cost optimizations, operating cost and downtime efficiencies, front-loaded infrastructure investment and minimal go-forward debt service requirements. The scaling benefits of its 2023 and 2024 growth wedge are expected to be realized in 2024, when DCRD anticipates Hammerhead's production to be 46,000-48,000 boe/d, at which point the company will begin harvesting substantial free cash flow. The combination of Hammerhead's expected production growth of approximately 50% between 2022 and 2024, low leverage, and a decarbonization investment program are together expected to result in a shareholder returns-focused energy company with a leading emissions reduction strategy anchored in measurement and reporting.

Hammerhead has already embarked on a decarbonization investment campaign across its asset base with its CCS program that is estimated to require $240 million of capital between 2023 and 2029. That program is expected to drive a reduction in Scope 1 and Scope 2 emissions of approximately 79% on an absolute basis and approximately 89% on a per boe basis by 2029, as compared to 2021 levels, with a further target to achieve net zero by 2030. In addition to that program, Hammerhead's ongoing and future investments are expected to address flaring and venting interventions, as well as renewable power transitions for its infield electrification requirements. The spend profile for Hammerhead's CCS program may be accelerated depending on cash generated from this transaction. Although Hammerhead is not underwriting any economic benefit or uplift from the CCS program nor planning for or presenting an accelerated investment program, Hammerhead's management believes its carbon management activities may become a valuable asset as Alberta's provincial carbon pricing framework continues to evolve.

Jim McDermott, DCRD's Lead Independent Director, a member of the Special Committee of DCRD's board of directors, and Founder and CEO of Rusheen Capital Management, a private equity firm that invests in growth-stage companies in the carbon capture and utilization, low-carbon energy and water sustainability sectors, said the following: "Having spent nearly two decades advancing a net zero investment strategy by addressing emissions as the centerpiece of sustainability, I am proud to have been at the formation and early-stage capital events in a number of highly consequential ventures in decarbonizing emitting categories. I believe the world must scale zero or low‑carbon replacements to fossil fuels quickly, and I celebrate consequential policy decisions that seek to accelerate the rollout of technologies such as direct air capture, hydro, modular nuclear, solar and wind. However, I also believe global political stability and growth is unlikely to occur without fossil fuels in the next two decades, if not longer. Rather than rejecting emitting categories from the table of net zero pathways, we should engage them as partners in the energy transformation. I believe carbon capture and storage is an essential bridge to a world that runs with a dramatically reduced fossil fuels profile, and the opportunity and potential for Hammerhead to showcase the potential of these convening themes is incredibly exciting. In my view, Hammerhead's course defines what will be required to be investible in oil and gas over the next decade."

Canada's Ministry of Environment and Climate Change has set objectives for all new oil and gas projects to be net zero by 2050. Canada has historically ranked amongst the top 5 largest producers of oil and natural gas in the world. In 2020, the oil and gas sector was the largest source of greenhouse gas emissions in Canada, accounting for 27% of the country's emissions. The Government of Canada has signaled its intention to introduce a robust tax credit program to incentivize and reward the development and adoption of CCS. While Hammerhead has not underwritten any financial uplift in its planning cases around decarbonization or carbon management, it intends to be in a very strong position to take advantage of certain contemplated government policies.

Transaction Details The transaction is anticipated to generate gross proceeds of approximately $320 million, assuming minimal redemptions. The funds will be used to accelerate Hammerhead's CCS program. The pre-money enterprise value of the combined company is C$1,390 million at a price of $10 per share. In the event of high redemptions by DCRD's public shareholders, and assuming Hammerhead's planning price deck prevails, Hammerhead would still expect to execute on the CCS program, but at a slower pace.

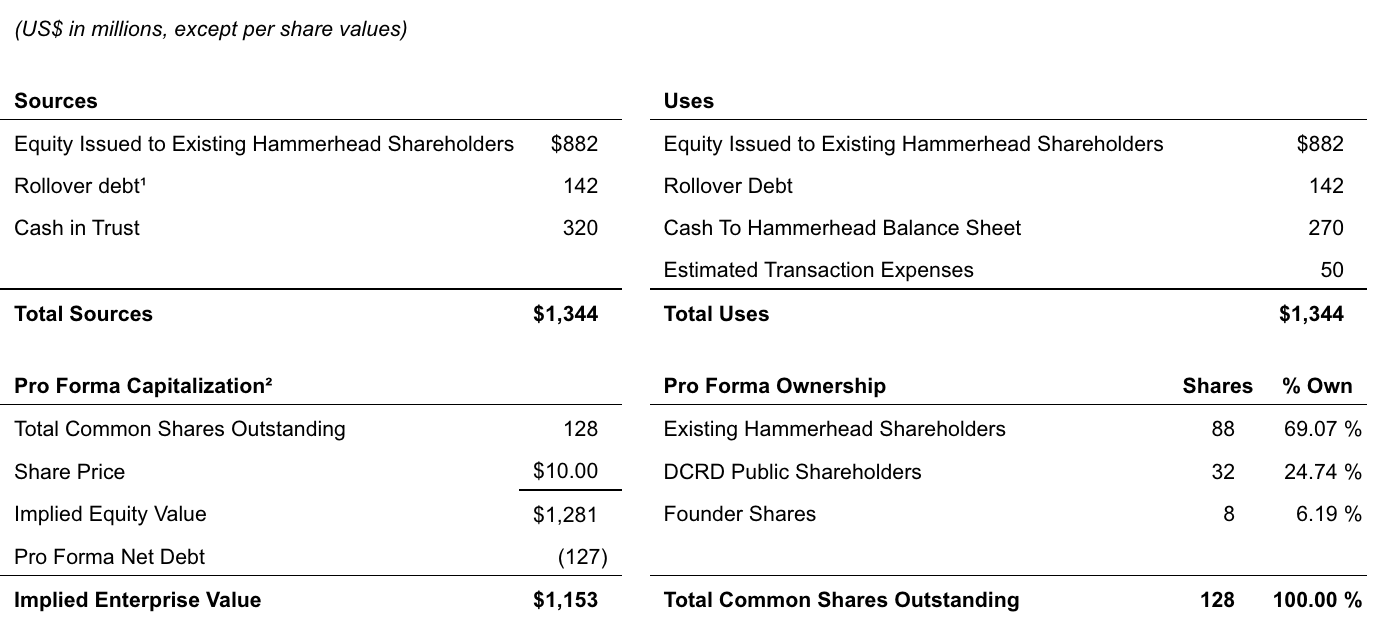

The below table outlines an illustrative sources and uses and pro forma capitalization and ownership for the transaction based on certain assumptions noted below.

Note: Assumes no public DCRD investors redeem their shares

1. Hammerhead net debt as of July 31, 2022

2. Excludes DCRD's 15,812,500 public warrants and 12,737,500 private placement warrants.

The warrants are exercisable on the later of 30 days after the completion of the Transaction and 12 months

from the closing of DCRD's initial public offering, and will expire five years after the completion of the Transaction

or earlier upon redemption or liquidation. The exercise price of each warrant is $11.50 per share.

Governance

Hammerhead is currently majority-owned and controlled by affiliates of Riverstone Holdings LLC ("Riverstone"). The board of directors of DCRD created a Special Committee comprised solely of directors not affiliated with Riverstone to review and approve the transaction and to make a recommendation to the board of directors of DCRD. The DCRD Special Committee engaged Kroll, LLC, operating through its Duff & Phelps Options Practice, to provide a fairness opinion to the DCRD Special Committee and Maples Group as its independent legal counsel for the transaction. The board of directors of Hammerhead also created a Special Committee comprised solely of directors not affiliated with Riverstone to review and oversee the transaction and make a recommendation to the Hammerhead board of directors. The Hammerhead Special Committee received a fairness opinion from Peters & Co. Limited that stated that the transaction is fair, from a financial point of view, to the Hammerhead common shareholders, other than Riverstone.

The transaction was unanimously recommended and approved by the Special Committees and boards of directors of both Hammerhead and DCRD. It remains subject to the approval of DCRD's and Hammerhead's shareholders and the satisfaction or waiver of other customary conditions.

Upon closing, the combined company is expected to feature a seven-person board of directors. Jim McDermott is expected to serve on the combined company's board, along with the six other individuals that will be designated by Hammerhead prior to closing.

Advisors

CIBC Capital Markets and Peters & Co. Limited are acting as financial and capital markets advisors to Hammerhead. National Bank Financial Inc. and ATB Financial are acting as strategic advisors to Hammerhead. Burnet Duckworth & Palmer LLP (CA) and Paul, Weiss, Rifkind, Wharton & Garrison LLP (U.S.) are acting as counsel to Hammerhead. Blake, Cassels & Graydon LLP acted as counsel to the Special Committee of the Hammerhead board of directors. Vinson & Elkins L.L.P. (U.S.), Walkers (Cayman Islands) and Bennett Jones LLP (CA) are acting as counsel to DCRD, and Maples Group is acting as counsel to the Special Committee of DCRD's board of directors.

About Decarbonization Plus Acquisition Corporation IV

Decarbonization Plus Acquisition Corporation IV is a blank check company formed for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business combination with a target whose principal effort is developing and advancing a platform that decarbonizes the most carbon-intensive sectors. DCRD is sponsored by an affiliate of Riverstone Holdings LLC.

About Hammerhead Resources

Hammerhead Resources is a Calgary, Canada-based energy company, with assets and operations in Alberta targeting the Montney formation. The Company was formed in 2009 and has over 85 employees as of September 1, 2022.

SOURCE Decarbonization Plus Acquisition Corporation IV

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

What Do Submarines Have to Do With Hydrogen?

Inside This Issue 🚢 Hyundai Pitches Hydrogen Transport Tied To Canada Submarine Bid 🧱 The LEGO Group Expands Its Portfolio Of Carbon Removal Solutions 🏆 SAF Pioneer LanzaJet Honored With RFA Indus...

-

This $4.1M Deal Could Change Carbon Capture's Playbook

Inside This Issue 🗜️ CarbonQuest Lands $4.1M Alberta Deal on Gas Compressors 🛡️ CADO, 123Carbon, and Assure SAF Registry Join Forces to Tackle SAF Integrity Gaps ✈️ ISCC, OMV, and Airbus Partner t...

-

Can Koloma Crack Iowa's Billion-Year-Old Secret?

Inside This Issue ⛏️ Iowa's Hydrogen Rush: Can Koloma Strike Gold Before Rules Kick In? ✈️ Bentley Commits to Use 100% Sustainable Aviation Fuel for Car Airfreight 🌬️ Minister Parrott Provides Upd...

Company Announcements

-

CHIFENG, China, Feb. 27, 2026 /PRNewswire/ -- Envision Energy launched the first global shipment of green ammonia from Chifeng, Inner Mongolia to LOTTE Fine Chemical, a premier chemical company in ...

-

SAF Pioneer LanzaJet Honored With RFA Industry Award

Pioneering sustainable aviation fuel producer LanzaJet received the Renewable Fuels Association’s 2026 Industry Award at the National Ethanol Conference in Orlando this week. Last year the company ...

-

Houston Hosts World Hydrogen North America 2026 Industry Gathering

Hydrogen is one of the energy sources that has evolved the most when it comes to how developers plan and execute projects. The main reason for this is the advanced technology that has penetrated th...

-

Trump EPA Eyes Reallocating Waived Biofuel Obligations To Refiners: Report

The question of whether to reallocate those exempted blending obligations to larger refiners is a point of contention between the agriculture and fuel industries The Trump administration has settl...