NET Power and Rice Acquisition Corp. II Secure $50 Million PIPE Commitment from SK Group and Announce Intent to Form Joint Venture to Accelerate Deployment of NET Power Plants in Asia

Published by Todd Bush on May 19, 2023

DURHAM, N.C.--(BUSINESS WIRE)--NET Power, LLC (“NET Power”) and Rice Acquisition Corp. II (NYSE: RONI) (“RONI”) today announced a $50 million PIPE commitment from SK Group (“SK”) in connection with NET Power’s and RONI’s proposed business combination. The groups also announced their intent to establish a NET Power-SK Joint Venture to pursue the origination and development of utility-scale NET Power plants across Asia.

The proposed NET Power-SK Joint Venture is expected to utilize NET Power’s patented oxy-combustion supercritical CO2 power cycle with SK's regional footprint and project development expertise to deploy clean, reliable and low-cost power across key Asian markets. Project origination and development work are expected to include activities such as site selection, supply and offtake contracting, financing and permitting.

Danny Rice, the incoming CEO of NET Power, emphasized the importance of decarbonizing Asian power generation to achieve global emissions goals. “Asian power generation, which is primarily fueled by coal, accounts for nearly 25% of global emissions," he said. "We believe that NET Power possesses the most cost-effective technology for decarbonizing fossil fuel-based power generation, and we are thrilled to partner with SK to deploy our NET Power plants on a large scale throughout Asia. SK is one of the largest and most respected conglomerates globally, and combining our expertise with their resources could accelerate our deployment in one of the largest markets for NET Power, and undoubtedly the most critical market for the planet.”

“NET Power’s technology is expected to help SK accomplish our pledge to achieve carbon net-zero across all businesses by 2050. Deploying NET Power plants throughout Asia is an important step forward in decarbonizing the region and ending a prevailing dependence on high-carbon intensity baseload power generation,” said SK Inc. Materials President Young-wook Lee.

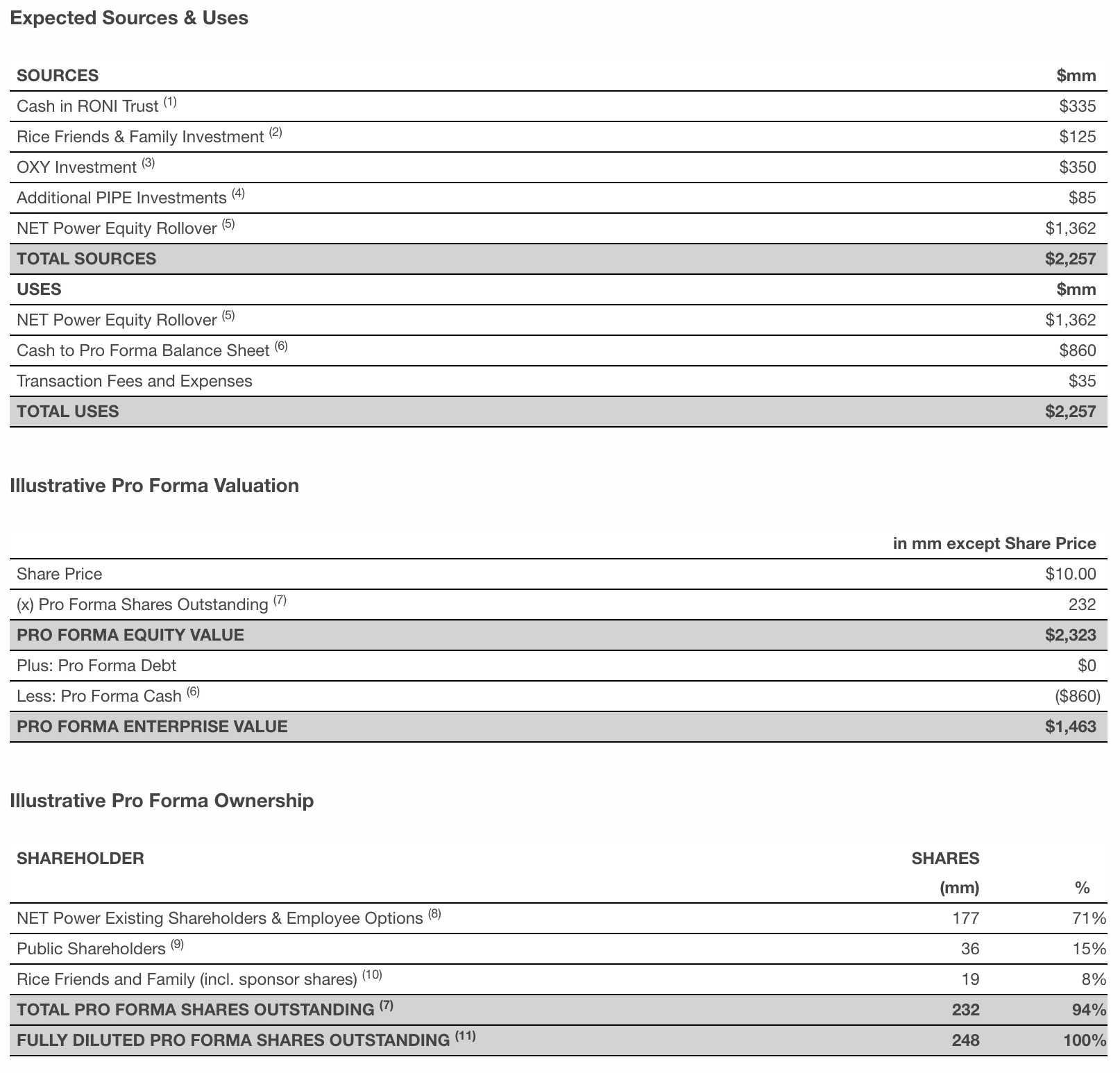

The new investment from SK brings the expected investment in NET Power to $895 million, consisting of approximately $345 million from RONI’s trust account (assuming no redemptions), approximately $540 million from the PIPE raised entirely at $10.00 per share of common stock and $10 million from interim financing from an existing owner of NET Power to support its operations through the closing of the business combination. Assuming no RONI shareholders exercise their redemption rights, the combined company is expected to have a market capitalization in excess of $2.0 billion.

NET Power and SK expect to each own a 50% stake in the common equity of the NET Power-SK Joint Venture, which is subject to negotiation and execution of definitive documentation.

As previously disclosed, NET Power expects to need only $200 million of net proceeds from the business combination and the PIPE to fully fund corporate operations through commercialization of SN1, which is expected to be operational in 2026. The anticipated net proceeds above $200 million are expected to support SN1 capital needs and future commercial origination efforts.

>> In Other News: Johnson Controls and Weas Development Break Ground at New State-of-the-art Glendale Engineering Center and Lab Space

Note: Amounts and percentages may not add up due to rounding.

(1) Assumes no RONI shareholders exercise redemption rights. Excludes the Rice family’s $10mm IPO investment. See footnote (2). Excludes interest earned on investments held in trust account.

(2) Rice Friends & Family includes non-redemption agreement for the Rice family’s $10mm IPO investment and an incremental $115mm investment via PIPE.

(3) $350mm Oxy investment includes $10mm pre-funded to support NET Power’s operations through transaction close.

(4) Includes $50mm PIPE commitment from SK Group.

(5) Rollover equity excludes $10mm Oxy investment pre-funded to support NET Power’s operations through transaction close.

(6) Cash to Pro Forma Balance Sheet includes $10mm Oxy investment pre-funded to support NET Power’s operations through transaction close.

(7) Pro Forma Shares Outstanding (i) excludes 1.0mm sponsor shares subject to a pro-rata earn-out at $12, $14 and $16 per share, (ii) excludes between 6.3mm and 12.5mm shares to be issued to Baker Hughes associated with funding of the Joint Development Agreement, (iii) excludes up to 2.1mm shares to be issued to Baker Hughes as “bonus shares” associated with achieving certain milestones as part of the Joint Development Agreement, (iv) excludes 10.9mm private warrants with a $11.50/share strike price and (v) excludes 8.6mm public warrants with a $11.50/share strike price.

(8) NET Power Existing Shareholders & Employee Options figure includes shares to be received pursuant to PIPE, including by owners of NET Power existing shareholders, such as SK.

(9) Public Shareholders figure includes 2.5mm PIPE shares of non-affiliates.

(10) RONI sponsor restructured its founder shares to better align interests with new investors including a forfeiture of 1.0mm sponsor shares, placing 1.0mm sponsor shares at-risk to share price increases and locking up 1.6mm sponsor shares for 3-years subject to early release at higher share price thresholds.

(11) Includes shares described in subsections (i) through (iii) of footnote 7 (i.e., excludes shares underlying public and private warrants).

About NET Power

NET Power is a clean energy technology company whose mission is to globally deploy affordable and reliable zero-emissions energy. The Company invents, develops, and licenses clean power generation technology. Founded in 2010 and headquartered in Durham, North Carolina, NET Power has received strategic investments from key industry partners including 8 Rivers, Constellation, Occidental, and Baker Hughes. For more information, please visit https://netpower.com/.

About Rice Acquisition Corp. II

RONI is led by Daniel Rice IV and Kyle Derham, former executives of Rice Energy, Inc. (“RICE”) and Rice Midstream Partners (“RMP”). In 2018 and 2019, RICE and RMP merged with EQT Corporation (NYSE: EQT) and EQT’s midstream affiliates for over $10 billion to become the largest U.S. natural gas producer. Rice Acquisition Corp. led a 2021 business combination with Archaea Energy LLC and Aria Energy LLC to create Archaea Energy, Inc. (formerly NYSE: LFG), an industry-leading renewable natural gas platform that BP p.l.c. (NYSE: BP) acquired for a cash consideration of $4.1 billion in December 2022, generating a 2.6x return on investment for LFG PIPE investors in approximately one year. Daniel Rice currently serves on the board of EQT. The RONI website is https://ricespac.com/rac-ii/.

About SK

SK Group, South Korea's second-largest conglomerate, is a collection of global industry-leading companies driving innovations in semiconductors, sustainable energy, telecommunications and life sciences. Based in Seoul, SK invests in building businesses around the world with a shared commitment to reducing global greenhouse gas emissions and increasing the use of renewable energy.

SK companies combined have $139 billion in global annual revenue and employ more than 100,000 people worldwide. SK companies are investing billions of dollars in expanding their U.S. presence with business operations or partnerships in hydrogen energy and fuel cells, EV battery manufacturing and technology, energy storage solutions, pharmaceutical manufacturing and development, semiconductors, and advanced materials. For more information, visit sk.com.

Participants in the Solicitation

RONI and NET Power and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from RONI’s shareholders in connection with the transaction. A list of the names of such directors and executive officers and information regarding their interests in the proposed transaction between RONI and NET Power are contained in the Proxy Statement/Prospectus. You may obtain free copies of these documents as described in the preceding paragraph.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

This $4.1M Deal Could Change Carbon Capture's Playbook

Inside This Issue 🗜️ CarbonQuest Lands $4.1M Alberta Deal on Gas Compressors 🛡️ CADO, 123Carbon, and Assure SAF Registry Join Forces to Tackle SAF Integrity Gaps ✈️ ISCC, OMV, and Airbus Partner t...

-

Can Koloma Crack Iowa's Billion-Year-Old Secret?

Inside This Issue ⛏️ Iowa's Hydrogen Rush: Can Koloma Strike Gold Before Rules Kick In? ✈️ Bentley Commits to Use 100% Sustainable Aviation Fuel for Car Airfreight 🌬️ Minister Parrott Provides Upd...

-

$47M Just Poured Into This SAF Producer

Inside This Issue 💰 LanzaJet Announces $47M in New Capital and First Close of Equity Round at $650M Pre-Money Valuation 🚢 Maersk's Ethanol Bet Could Reshape U.S. Fuel Markets 🪨 Canada Nickel and t...

Company Announcements

-

RCJY and Climeworks Deepen Partnership to Advance Large-scale Direct Air Capture in Saudi Arabia

Key takeaways: Under the guidance of the Ministry of Energy, the Royal Commission for Jubail and Yanbu and Climeworks have signed a Memorandum of Understanding to expand their collaboration on de...

-

CHARBONE Confirms New UHP Hydrogen Orders and its First UHP Oxygen Order in the United States

Brossard, Quebec, February 25, 2026 – CHARBONE CORPORATION (TSXV: CH; OTCQB: CHHYF; FSE: K47) (“CHARBONE” or the “Company”), a North American producer and distributor specializing in clean Ultra Hi...

-

Climeworks Establishes Canadian Headquarters in Calgary

Calgary, Alberta, February 20, 2026 — Climeworks, a global leader in commercial carbon removal, has established its Canadian headquarters at Calgary’s ETC, one of Alberta’s leading hubs where start...

-

MIAMI, Feb. 24, 2026 /CNW/ - Power Sustainable Infrastructure Credit ("PSIC") recently closed an $85M senior secured financing for Sagepoint Energy ("Sagepoint"), a vertically integrated renewable ...