Outpost Raises $7.1M Seed Round to Develop Reusable Satellites for Earth Return Service

Published by Todd Bush on August 31, 2022

August 30, 2022 10:00 AM Eastern Daylight Time SANTA MONICA, Calif.--(BUSINESS WIRE)--Outpost Technologies Corporation ('Outpost'), the sustainable space company, announced the closing of a $7.1M Series Seed round. During a bearish fundraising environment, this round was oversubscribed, demonstrating Outpost's visionary approach to disrupting the satellite market. The company has developed, and flight tested a novel re-entry method that enables satellites to safely return to Earth with precision landing. This technology not only makes single-use satellites obsolete, but also enables the broader aerospace market to attain dedicated payload return to Earth. This round of funding will enable Outpost to advance technology development and build their team with exceptional talent.

Outpost is spearheading a new way of space development that’s reusable, not disposable. With its very first product, Outpost is building reusable satellites that deliver customer payloads to space and back to Earth.

>> In Other News: Canadian Solar Awarded 253 MWp Solar plus 1,000 MWh Battery Energy Storage Project in Chile Public Tender

"Outpost is reimagining, from first principles, how a satellite mission would change if the satellite were reusable," said Jason Dunn, CEO and co-founder at Outpost and previously founder at Made In Space. "We believe that our approach will be the default expectation of the market over the coming years, and that the current single-use satellite approach will eventually disappear. It is a gamechanger for our customers."

The seed round was led by Moonshots Capital, with participation from Draper Associates, Starlight Ventures, Kittyhawk Ventures, AIR Capital, Starburst Ventures, and Shasta Ventures. This cohort of investors represents industry leaders in space and frontier technology with a strong track record and a deep understanding of the market Outpost is operating in. "In the last 20 years, we've seen how reusability for rockets has transformed launch, and we believe that the Outpost team will lead an equally important disruption in satellite operations that is critical for the $270B satellite industry to reach its full potential," said Craig Cummings, partner at Moonshots and future board member at Outpost.

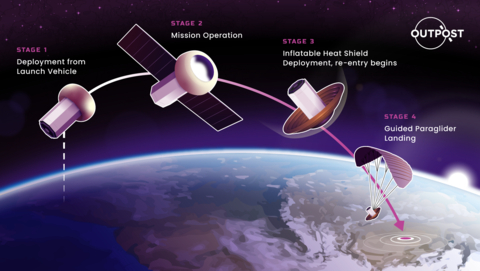

"The only available options for returning satellites to Earth are costly and inefficient," said Michael Vergalla, CTO and co-founder at Outpost. "Our two-stage re-entry system offers low-mass, high-efficiency Earth Return, and our advanced autonomous paraglider technology delivers unparalleled landing precision for full recovery of satellites from space."

About Outpost

Outpost is spearheading a new way of space development that's reusable, not disposable. With its very first product, Outpost is building reusable satellites that deliver customer payloads to space and back to Earth. By flying payloads with Outpost, users can put their product into space, iterate, and learn how they performed in space. Outpost facilitates iteration in space at a quicker pace than anything else available. The future of space (and Earth) requires a focus on low-cost reusability to create a sustainable industry. At Outpost, we are proud to be leading the charge to develop products with sustainability as the core design.

Learn more at www.outpost.space.

About Moonshots Capital

Moonshots Capital is a seed-stage venture capital firm that invests in extraordinary leadership.

Great leaders are hard to come by. We believe the best ones are military-trained or trial-by-fire entrepreneurs who have the ability to motivate others to action, inspire trust, and plan heuristically. We invest with conviction when those attributes are present.

Moonshots Capital, with offices in Los Angeles and Austin, was founded by a team of veterans in 2017. We have collectively founded and operated 15 companies and have personally invested in over 100 ventures. Beyond capital, we deploy our military and entrepreneurial experience and network to help world-changing companies grow.

Learn more at www.moonshotscapital.com.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

Canada Nickel Just Buried CO₂ Before Mining Even Started

Inside This Issue ⛏️ Canada Nickel And UT Prove Mining Can Fight Climate Change 🛰️ OGCI And Carbon Mapper Team Up To Reduce Methane Emissions From The Oil And Gas Sector 🚛 RNG Continues To Lead As...

-

96% Pure H₂ Found Underground — Now What?

Inside This Issue 🧪 HyTerra's Kansas H₂ Could Power a Historic Industry First 🤝 Prime Minister Carney Secures Ambitious New Partnership With India Focused on Energy, Talent, and Technology Françai...

-

What Do Submarines Have to Do With Hydrogen?

Inside This Issue 🚢 Hyundai Pitches Hydrogen Transport Tied To Canada Submarine Bid 🧱 The LEGO Group Expands Its Portfolio Of Carbon Removal Solutions 🏆 SAF Pioneer LanzaJet Honored With RFA Indus...

Company Announcements

-

B.C. Pulp Mill Puts Green Hydrogen to the Test

The Kamloops Pulp Mill, which has been in operations for more than 50 years, was acquired by Kruger Inc. in 2022. It will soon test using green hydrogen in part of the pulp-and-paper-making process...

-

Pressurized Formation Water Inflow Observed Elevated Hydrogen Detected Across Full 72 m Structural Interval Drilling Continues Toward 650 m in First Hole of Five-Hole 2026 Advocate Program Montr...

-

BERLIN – The investor consortium comprising the Paris-based Next Generation Fuels Industrial & Technological fund Calderion (Audacia), alongside infrastructure developer Terravent and WenCo Fam...

-

CF Industries Points to Blooming Fertilizer Market in 2026

Despite a major setback at one of its U.S. plants, CF Industries as a positive outlook for the fertilizer market in 2026. Summary Despite a major setback at one of its U.S. plants, CF Industries ...