In a significant step towards furthering clean energy efforts, the U.S. Department of Energy (DOE) has opened its Emissions Value Request Process, supporting the implementation of the Clean Hydrogen Production Tax Credit (45V), enacted under the Inflation Reduction Act (IRA).

>> RELATED: Department of Energy Opens Emissions Value Request Process for Clean Hydrogen Production

This milestone marks a critical opportunity for hydrogen producers to align their production processes with low-emission standards, gaining recognition and financial incentives for their contributions to cleaner energy.

The 45V tax credit encourages cleaner hydrogen production by offering significant tax breaks to producers who meet stringent emissions standards.

With the launch of the Emissions Value Request Process, the DOE aims to help hydrogen producers assess and quantify the emissions involved in their hydrogen production processes, paving the way for these producers to receive the tax credits they deserve.

This initiative is closely aligned with broader national goals of reducing carbon emissions and fostering a transition to a cleaner, more sustainable energy landscape.

Understanding the Emissions Value Request Process

The Emissions Value Request Process offers an essential mechanism for hydrogen producers whose technology and feedstock are not included in the latest version of the 45VH2-GREET model.

The GREET model (Greenhouse Gases, Regulated Emissions, and Energy Use in Technologies) is a comprehensive tool used to estimate the lifecycle emissions of various fuels and energy systems.

However, for hydrogen producers employing emerging or alternative technologies, the Emissions Value Request Process provides a pathway to request a specific emissions value from the DOE.

This request is critical because the emissions value obtained from the DOE is required for taxpayers to petition the Internal Revenue Service (IRS) for a determination of a provisional emissions rate (PER).

In simple terms, hydrogen producers need to establish a recognized emissions value in order to access the tax credits offered by the 45V program. "Hydrogen producers now have a clearer path to participate in the 45V tax credit initiative, which could make a substantial difference in advancing cleaner energy technologies," said DOE Secretary Jennifer Granholm.

By utilizing this process, hydrogen producers can submit their emissions data and work with the DOE to obtain a recognized emissions rate.

Once this emissions value is established, the hydrogen producer can apply for the 45V tax credit, receiving valuable financial support that can be reinvested into further clean energy production efforts.

Collaboration Between the DOE and the Treasury

The opening of the Emissions Value Request Process stems from a collaborative effort between the DOE and the U.S. Department of the Treasury.

Treasury first introduced this process in its December 2023 Notice of Proposed Rulemaking for the 45V tax credit, outlining the framework for clean hydrogen production tax incentives.

In April 2024, Treasury issued a supplemental notice inviting stakeholders to provide feedback on the proposed information collection methods for the Emissions Value Request Process.

The DOE and Treasury carefully reviewed comments from industry stakeholders and refined the procedures and requirements for accessing the Emissions Value Request Process based on this feedback.

The refined process offers hydrogen producers an opportunity to submit their emissions data, and the DOE has now begun accepting applications from producers seeking to qualify for the 45V tax credit.

This process reflects the federal government’s ongoing efforts to facilitate clean energy development through effective policy and regulatory support.

By offering hydrogen producers a streamlined pathway to access tax credits, the DOE and Treasury are fostering the growth of hydrogen as a key component of the nation's clean energy transition.

The Importance of Clean Hydrogen Production

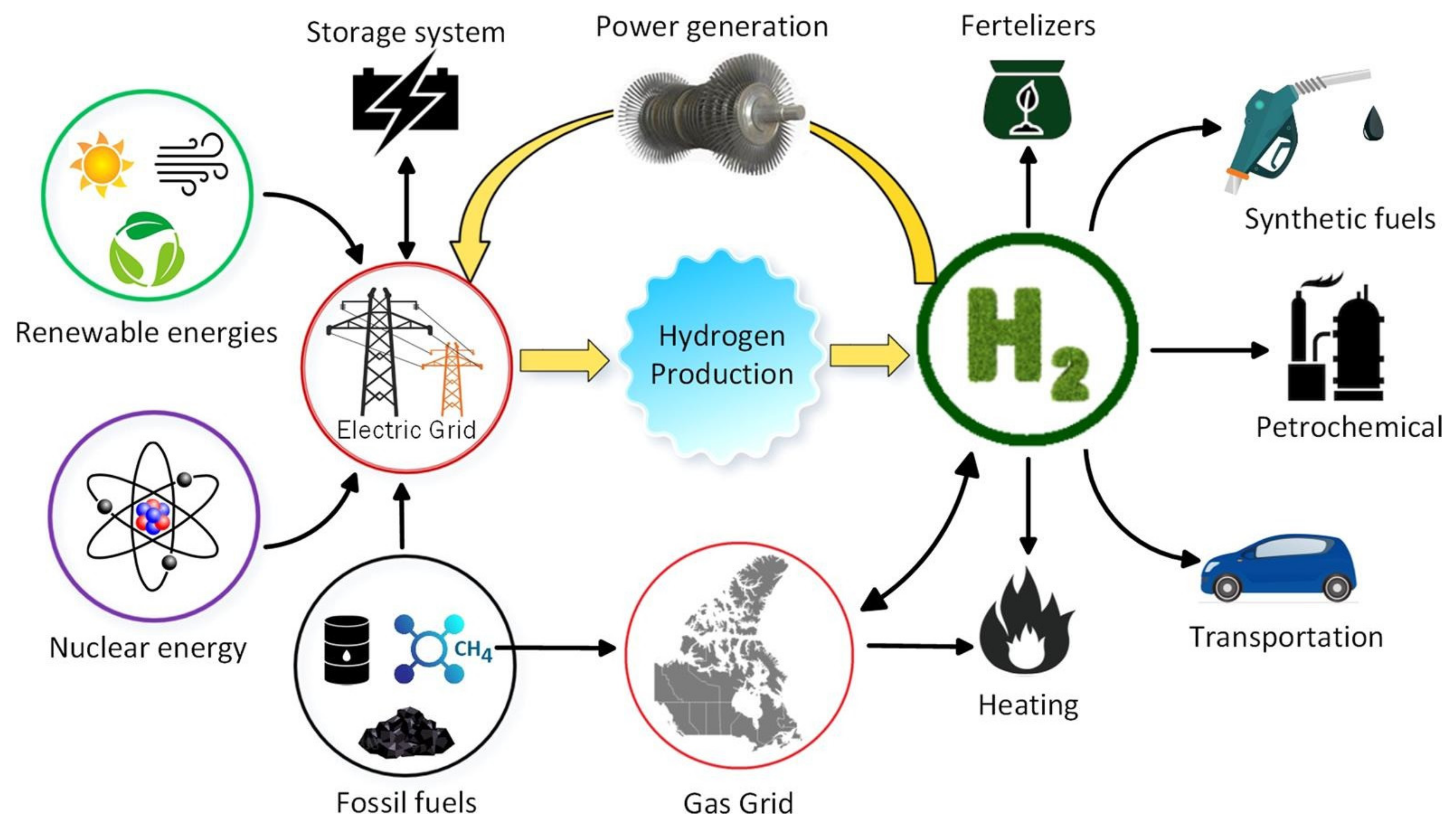

Hydrogen is increasingly seen as a pivotal energy source in the global push toward decarbonization.

As a versatile and efficient fuel, hydrogen has the potential to reduce emissions in a wide range of industries, including transportation, power generation, and manufacturing.

However, to fully unlock hydrogen’s potential, it is crucial that hydrogen be produced in a way that minimizes carbon emissions.

The 45V tax credit is an important tool in this effort, providing financial incentives to hydrogen producers who adopt low-emission production methods.

This tax credit encourages investment in cleaner hydrogen technologies and helps hydrogen producers offset the costs associated with developing and implementing these technologies.

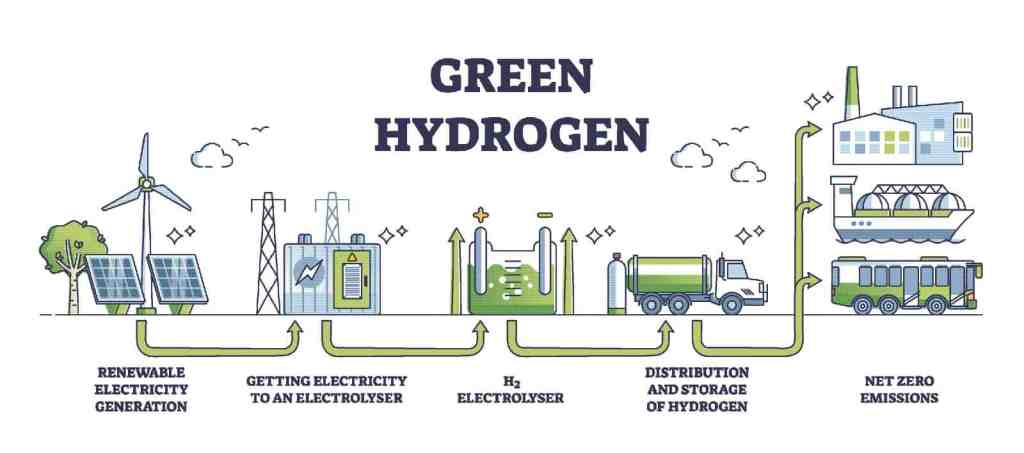

Hydrogen production can be classified into several types, including green hydrogen, which is produced using renewable energy sources like wind or solar power, and blue hydrogen, which is produced from natural gas but incorporates carbon capture and storage technologies to reduce emissions.

Both green and blue hydrogen production methods are essential to the clean energy transition, but achieving widespread adoption of these methods requires continued government support and investment.

"The future of clean energy will be driven by innovation in technologies like hydrogen production," said Secretary Granholm. "By providing financial support and encouraging the adoption of low-emission technologies, we can accelerate the transition to a more sustainable energy system."

A Path Forward for Clean Energy

The opening of the Emissions Value Request Process is a testament to the federal government's commitment to advancing clean energy and supporting hydrogen producers in their efforts to reduce carbon emissions.

By offering hydrogen producers the opportunity to qualify for the 45V tax credit, the DOE and Treasury are fostering the development of cleaner hydrogen technologies and helping to lay the groundwork for a more sustainable energy future.

This initiative aligns with broader national and global efforts to combat climate change by reducing greenhouse gas emissions and promoting cleaner energy sources.

As hydrogen continues to gain traction as a key player in the clean energy landscape, the 45V tax credit will play an important role in ensuring that hydrogen production is aligned with sustainability goals.

The DOE’s Emissions Value Request Process is a critical step forward in supporting the growth of clean hydrogen production.

With the support of the 45V tax credit, hydrogen producers have a unique opportunity to lead the charge in the clean energy transition and contribute to a more sustainable future for all.

As the DOE and Treasury continue to collaborate on refining and implementing the 45V program, hydrogen producers are encouraged to take advantage of the Emissions Value Request Process and apply for the tax credits that can help drive their clean energy efforts forward.

For more information on the Emissions Value Request Process and how hydrogen producers can apply, visit the DOE’s official website.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

Kita's $29M Bet Signals Carbon Insurance Is Here

Inside This Issue 🛡️ Kita's $29M Bet Signals Carbon Insurance Is Here 🏗️ CCI BioEnergy Selects Arcadis As Design-Engineer Partner Under Master Service Agreement 🤝 Tapestry and Climeworks Announce ...

-

Cummins Quit Electrolyzers. Electric Hydrogen Didn't.

Inside This Issue ⚡ Cummins Quit Electrolyzers. Electric Hydrogen Didn't. 🧪 New Electrified Method Captures Carbon Dioxide From Air 🌾 Iowa Could Be on the Cusp of a Hydrogen Rush; Lawmakers Weigh ...

-

Inside America’s Carbon Capture Reality Check

Inside This Issue ⚡ Duke Energy Florida Goes Live With First 100% Hydrogen System ✈️ Air bp Signs Agreement With Airbus on Flight Services and Fuel Supplies in Europe 🌊 Pairing Reefs and Mangroves...

Company Announcements

-

Vancouver, British Columbia--(Newsfile Corp. - February 18, 2026) - Element One Hydrogen & Critical Minerals Corp. (CSE: EONE) ("Element One" or the "Company") is pleased to announce the format...

-

CCI BioEnergy Selects Arcadis As Design-Engineer Partner Under Master Service Agreement

First project under the agreement will contribute to doubling the processing capacity of Toronto’s Disco Road Organic Processing Facility Toronto, ON – Arcadis (EURONEXT: ARCAD) is pleased to anno...

-

QIMC Reports Diamond Drilling Underway at West Advocate Hydrogen Project, Nova Scotia

Montreal, Quebec-- Québec Innovative Materials Corp. QIMC (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") announces that diamond drilling operations commenced on February 17, 2026, at its West ...

-

Seaweed Farming Could Remove Millions of Tons of CO₂ Each Year, Study Finds

Seaweed farming is a key strategy for carbon dioxide removal (CDR), offering both climate mitigation and ecological benefits. A recent study published in Communications Sustainability examined how ...