Decarbon Daily - Energy IPOs, Lucid, & DOE Awards

Inside this issue

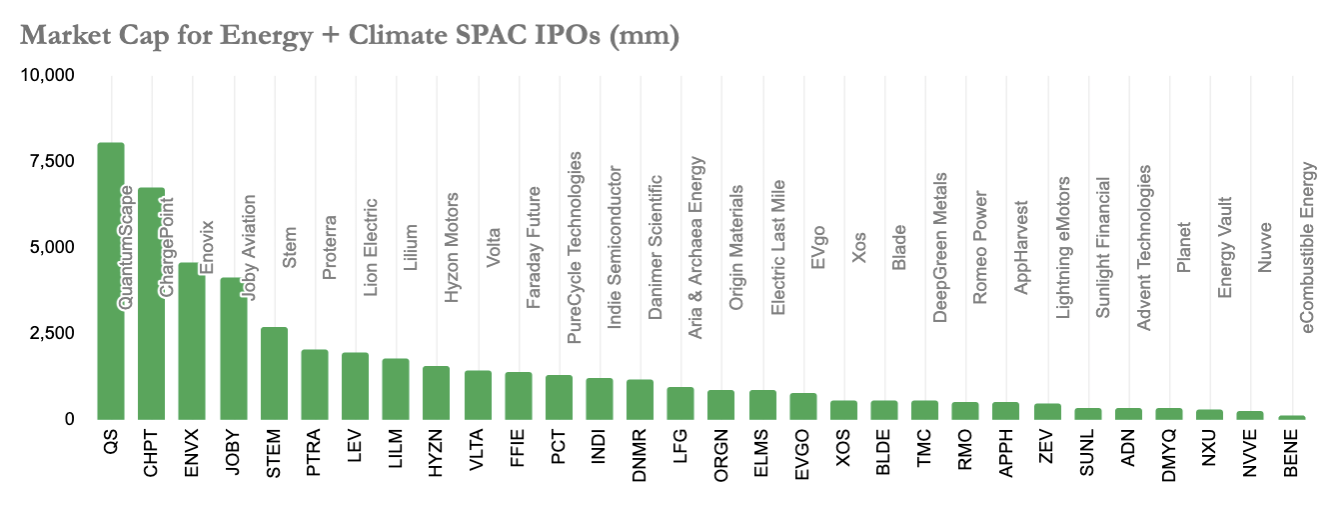

Energy & Climate Focused SPAC IPOs

On Friday, I covered SPAC IPO data that raised a few questions from readers:

- Who are the energy and climate focused SPAC IPOs? See Google spreadsheet

- How are those companies performing? Review share prices and market capitalization for ~30 energy and climate IPOs

- How long can SPAC-mania last? This is an unknown but the SEC is certainly investigating more and more SPAC IPOs

The Special Purpose Acquisition Company (SPAC) gained popularity during 2020 and accelerated in 2021 with more than 559 IPOs (and counting).

For energy and climate companies that have a proven model and need capital to scale, the SPAC may be an ideal vehicle. However, there are lingering concerns and risks due to numerous SEC investigations.

Lucid Motors has a market cap of nearly $73 billion after Churchill Capital Group SPAC acquired the business and took it public in July 2021. Lucid is now the fourth EV start-up to be investigated, the others were Nikola, Canoo, and Lordstown Motors.

Most SPAC deals involving EV start-ups were initially celebrated by investors, sending shares through the roof and making some founders millionaires, if not billionaires, overnight. But the tides have turned against many of the companies after crackdowns this year by the SEC, including investigations, warnings to investors and potential changes to accounting guidelines. Source: CNBC

Removing Lucid Motors from the list of companies provides a better view of the range of market capitalizations for energy and climate SPAC IPOs. Current market caps range from $8 billion to $120 million with only 1 company, Energy Vault, within 10% of the stock's 52-week high.

Inside this Issue

🚗 Shares of EV start-up Lucid tank on SEC probe

🌊 Siemens Gamesa partners on offshore wind-to-hydrogen

❇️ BlueScope Steel, Shell Sign MoU to Develop Hydrogen Projects at Port Kembla

🛑 DOE Awards $35 Million for Technologies to Reduce Methane Emissions

Articles in this issue