The clean energy revolution is underway, powered by American innovation and Canadian leadership. Billions in new investment are fueling a wave of groundbreaking projects across North America, from advanced aviation fuels made from corn to massive pipelines that turn carbon emissions into a resource.

From South Dakota cornfields to Alberta's industrial heartland, unprecedented federal support and private investment are building the infrastructure for a decarbonized economy. The scale is staggering, the momentum is real, and North America is establishing itself as the global center of clean energy innovation.

"This marks a watershed moment for the Net-Zero 1 project and a critical step forward in Gevo's mission to transform the aviation industry by providing a scalable, sustainable, and economical renewable-carbon-based jet fuel."

Dr. Patrick Gruber, CEO, Gevo

American Agriculture Takes Flight with SAF

The U.S. Department of Energy's Sustainable Aviation Fuel Grand Challenge isn't just a goal, it's becoming reality. The target of 3 billion gallons per year by 2030 already has announced projects exceeding that capacity, with over $44 billion in investment and more than 70,000 jobs across the SAF value chain.

Two flagship projects are leading the charge. Gevo's Net-Zero 1 facility in Lake Preston, South Dakota secured a $1.46 billion conditional loan commitment from the DOE in October 2024. The plant will produce approximately 60 million gallons of SAF annually using 100% U.S.-sourced corn feedstock, along with 1.3 billion pounds of protein products.

Montana Renewables is following close behind with an even larger commitment. The company closed on a $1.44 billion DOE loan facility in January 2025 to expand its Great Falls refinery. Once complete, the facility will produce approximately 300 million gallons of SAF annually, positioning it as one of the world's largest SAF producers and accounting for roughly half of all North American SAF through 2030.

Major U.S. SAF Investments at a Glance

- Gevo Net-Zero 1 (South Dakota): $1.46B loan, 60 million gallons/year capacity

- Montana Renewables (Montana): $1.44B loan, 300 million gallons/year capacity

- Expected jobs: 1,000+ construction jobs per project, 90-130 permanent positions

- Total announced capacity: Over 3 billion gallons/year by 2030

- Economic impact: $44+ billion in total investment

What makes these projects transformative isn't just their scale. They're creating entirely new economic opportunities for American farmers through climate-smart agriculture practices. Gevo's approach rewards farmers who adopt regenerative techniques, creating a business system where sustainability improvements directly translate to better income.

>> RELATED: Direct Air Capture: The Technology Racing to Scale Carbon Removal

![Map denotes Gevo supplied AT] SAF from our demonstration facilities](https://i.imgur.com/Hi6IN9s.jpeg)

Canada's CCS Leadership Sets Global Standard

While the U.S. races ahead on SAF, Canada has established itself as the undisputed global leader in commercial-scale carbon capture and storage. Alberta's two flagship projects have safely captured and stored more than 11.5 million tonnes of CO2 since 2015, proving the technology works at scale.

The Quest Project, operated by Shell at the Scotford upgrader, captures up to 1.08 million tonnes of CO2 annually from oil sands operations. The captured carbon travels 65 kilometers north for permanent storage two kilometers below the earth's surface in a deep saline aquifer.

Even more impressive is the Alberta Carbon Trunk Line (ACTL), the largest carbon capture infrastructure project in Canada. The 240-kilometer pipeline began operations in June 2020 and is designed for an ultimate capacity of 14.6 million tonnes per year. The system captures CO2 from industrial facilities in Alberta's Industrial Heartland and transports it to depleted oil reservoirs for enhanced oil recovery and permanent storage.

Why Canada's CCS Projects Matter

Canada isn't keeping this knowledge to itself. Both the Quest and ACTL projects are required to share technical information and lessons learned through Alberta's CCS Knowledge Sharing Program. This creates a global blueprint for carbon management that other regions can adapt and deploy.

The Alberta government has invested $1.24 billion over 15 years in these projects, and the returns go far beyond emissions reduction. The infrastructure is creating high-paying technical jobs, supporting regional economies, and positioning Canada as a technology exporter for CCS solutions worldwide.

| Project | Annual Capacity | Status | Total Captured Since Launch |

|---|---|---|---|

| Quest Project | 1.08 million tonnes | Operating since 2015 | Part of 11.5M+ total |

| Alberta Carbon Trunk Line | 14.6 million tonnes (full capacity) | Operating since 2020 | Part of 11.5M+ total |

Hydrogen Hubs Unlock Hard-to-Abate Sectors

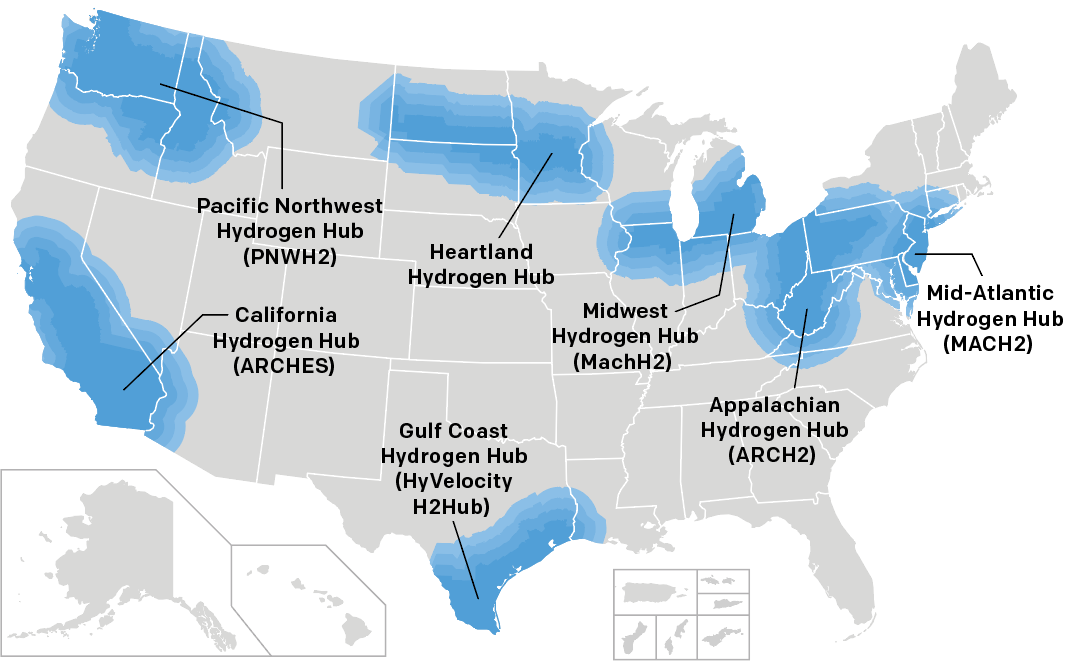

The Biden administration's $7 billion investment in seven Regional Clean Hydrogen Hubs represents one of the most ambitious industrial decarbonization programs in American history. When combined with private sector matching funds, these hubs will catalyze more than $40 billion in total investment.

Two major hubs received their funding commitments in late 2024. The Gulf Coast Hydrogen Hub (HyVelocity), centered in Houston, secured up to $1.2 billion in federal funding and is expected to create approximately 45,000 direct jobs over the project's lifetime. The hub will leverage the region's abundant renewable energy and natural gas supply to produce clean hydrogen through both electrolysis and natural gas with carbon capture.

"With this historic investment, the Biden-Harris Administration is laying the foundation for a new, American-led industry that will propel the global clean energy transition while creating high quality jobs and delivering healthier communities in every pocket of the nation."

Jennifer Granholm, U.S. Secretary of Energy

The Midwest Hydrogen Hub (MachH2) spans Illinois, Indiana, Iowa, and Michigan with up to $1 billion in federal funding. This hub will focus on decarbonizing steel and glass production, manufacturing, power generation, refining, and heavy-duty transportation. The project anticipates creating approximately 12,000 direct jobs.

The Seven Regional Hydrogen Hubs

- California Hub (ARCHES): $1.2B, renewable energy focus, 220,000 expected jobs

- Gulf Coast Hub (HyVelocity): $1.2B, natural gas with CCS and electrolysis, 45,000 jobs

- Midwest Hub (MachH2): $1B, industrial decarbonization focus, 12,000 jobs

- Pacific Northwest Hub: $1B, power generation and storage applications

- Appalachian Hub (ARCH2): $925M, leveraging regional natural gas with CCS

- Heartland Hub: Focus on agricultural applications and fertilizer production

- Mid-Atlantic Hub: Regional industrial and transportation decarbonization

These hubs aren't isolated projects. They're designed as complete ecosystems bringing together hydrogen producers, consumers, and connective infrastructure. Each hub addresses regional needs while contributing to a national hydrogen network that will transform sectors like heavy-duty transportation, fertilizer production, steel manufacturing, and power generation.

>> In Other News: Chemistry Nobel Given for Molecules That Aid Carbon Capture

Next Generation Carbon Removal Takes Root

Beyond traditional carbon capture from industrial sources, North America is becoming the testing ground for Direct Air Capture (DAC) and other next-generation carbon removal technologies. These projects represent the frontier of decarbonization, pulling CO2 directly from the atmosphere and creating new economic sectors around carbon management.

The Department of Energy has launched multiple funding opportunities to accelerate these technologies, recognizing that achieving net-zero emissions will require both reducing new emissions and removing legacy carbon from the atmosphere. Early-stage projects are already demonstrating technical viability, with costs declining as scale increases.

What makes this moment different is the convergence of technology maturity, policy support, and private capital. Major corporations are making advance purchase commitments for carbon removal credits, creating market certainty that enables project developers to secure financing and begin construction.

Key Investment Drivers

- Federal funding: $7B+ for hydrogen hubs, billions more for SAF and CCS

- Tax incentives: Section 40B and 45Z credits for SAF, 45Q for carbon capture

- Private capital: $40B+ in matching funds for hydrogen hubs alone

- Corporate commitments: Long-term offtake agreements creating market certainty

- Proven technology: Operational projects demonstrating commercial viability

Building the North American Clean Energy Advantage

What's happening across North America isn't just about individual projects, it's about building integrated infrastructure that creates competitive advantages for decades to come. The combination of U.S. manufacturing and innovation capacity with Canadian technical expertise in CCS is establishing North America as the global center for clean energy deployment.

The numbers tell the story. More than $50 billion in combined public and private investment is flowing into SAF, CCS, and hydrogen projects. Tens of thousands of high-quality jobs are being created in regions that need economic opportunity. Agricultural communities are discovering new revenue streams. Industrial heartlands are securing their competitive position for the next century.

The momentum is irreversible because the economics are working. Projects aren't moving forward because of mandates alone, they're advancing because the combination of technology maturity, policy support, and market demand has made clean energy profitable. That's what transforms an industry.

North America's clean energy revolution is more than an environmental initiative, it's an economic transformation powered by innovation, scale, and the recognition that decarbonization represents opportunity, not obligation.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

Canada Nickel Just Buried CO₂ Before Mining Even Started

Inside This Issue ⛏️ Canada Nickel And UT Prove Mining Can Fight Climate Change 🛰️ OGCI And Carbon Mapper Team Up To Reduce Methane Emissions From The Oil And Gas Sector 🚛 RNG Continues To Lead As...

-

96% Pure H₂ Found Underground — Now What?

Inside This Issue 🧪 HyTerra's Kansas H₂ Could Power a Historic Industry First 🤝 Prime Minister Carney Secures Ambitious New Partnership With India Focused on Energy, Talent, and Technology Françai...

-

What Do Submarines Have to Do With Hydrogen?

Inside This Issue 🚢 Hyundai Pitches Hydrogen Transport Tied To Canada Submarine Bid 🧱 The LEGO Group Expands Its Portfolio Of Carbon Removal Solutions 🏆 SAF Pioneer LanzaJet Honored With RFA Indus...

Company Announcements

-

CF Industries Points to Blooming Fertilizer Market in 2026

Despite a major setback at one of its U.S. plants, CF Industries as a positive outlook for the fertilizer market in 2026. Summary Despite a major setback at one of its U.S. plants, CF Industries ...

-

First VM0042 project to issue credits in North America and largest globally delivers verified removals while uplifting ranching communities. ❮ ❯ Boomitra today announced the l...

-

Milestone advances Phase I of Louisiana Green Fuels Project 24/7 renewable carbon neutral electric power plus carbon capture and sequestration COLUMBIA, La.--(Business Wire)--Strategic Biofuels, a...

-

OGCI And Carbon Mapper Team Up To Reduce Methane Emissions From The Oil And Gas Sector

OGCI, Carbon Mapper collaboration combines public satellite methane data and science-driven strategy with industry-led engagement. Mitigating methane emissions is one of the fastest and most effec...