A new wave of CO2 removal is emerging

For years, carbon capture felt like a side note in climate talks—technically impressive but economically sluggish. That’s changing fast. As carbon markets rebound and net zero deadlines close in, carbon dioxide removal (CDR) is becoming the backbone of credible climate commitments.

Two innovations are leading the charge: scalable, bio-based technologies like carbon capture surfaces (CCS) and the biochar boom driven by offtake agreements. Together, they're unlocking a more reliable, cost-effective carbon market—one square meter at a time.

Why carbon capture needs a fresh playbook

The Intergovernmental Panel on Climate Change (IPCC) says we must remove up to 10 gigatons of CO2 per year by 2050. Yet, as of 2025, most direct air capture (DAC) systems only remove 10,000 tons annually. That’s not just slow—it’s wildly inadequate.

Meanwhile, the global carbon market plunged from $1.87 billion in 2023 to $723 million in 2024 as confidence in avoided-emissions credits collapsed. The future? High-integrity removal credits—especially ones tied to verifiable, scalable systems.

>> RELATED: What It’ll Really Take to Make Carbon Capture and Storage Work

How Reactive Surfaces makes carbon capture modular and profitable

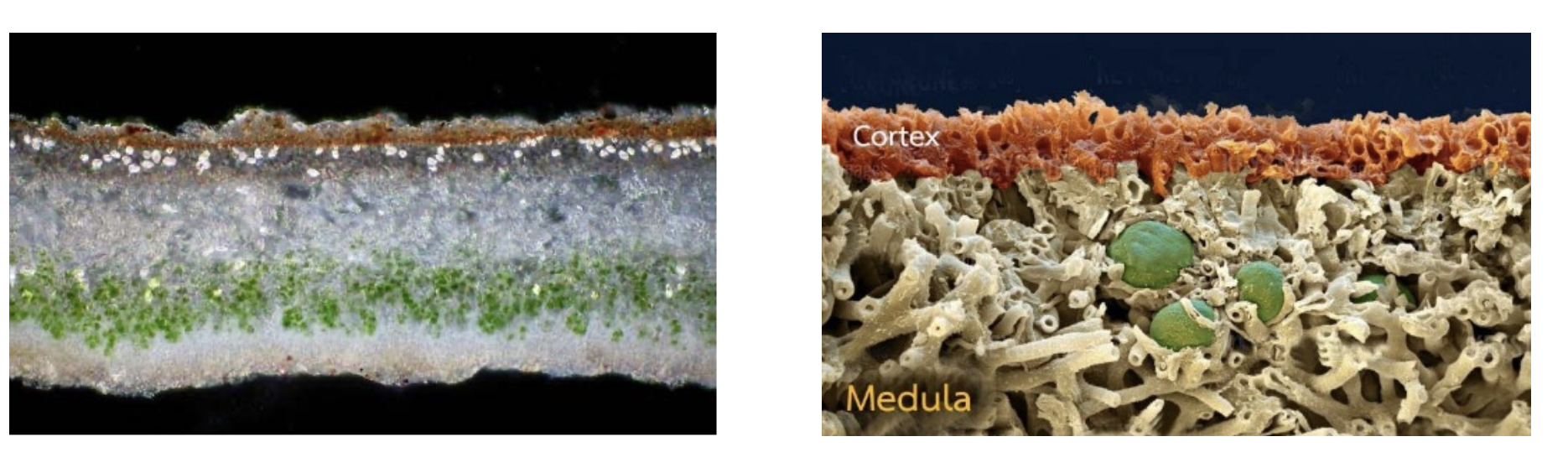

Reactive Surfaces is changing the game with carbon capture surfaces (CCS): thin, algae-coated substrates that pull CO2 directly from the air. These panels are compact, energy-efficient, and designed for plug-and-play scalability.

A single 1m3 module contains up to 20m2 of algae-growing surface and can remove 0.1 tons of CO2 per year. The secret? Algae photosynthesize to convert carbon into stable biomass, which is then dried and stored—or sold as biochar, animal feed, or cosmetics.

As BETH MCDANIEL, President of Reactive Surfaces, explained, "We're not just capturing CO2—we're building a circular carbon economy."

Four reasons carbon capture surfaces matter now

1. Low footprint, high yield

Each unit occupies just one square meter and runs entirely on solar energy, making it both compact and self-sustaining. This means rooftops, farms, and otherwise idle land can be transformed into productive carbon sinks, without major infrastructure. The low footprint allows for easy integration into existing spaces while contributing to meaningful CO2 removal. It's a smart fit for decentralized climate solutions.

2. Built-in monitoring

Each CCS module continuously monitors CO2 capture, oxygen output, and environmental conditions to ensure optimal performance. This level of real-time visibility is critical, especially in a market increasingly focused on verification and data transparency. It gives buyers confidence and suppliers a clear performance record.

3. Passive revenue for farmers

A 1,000-module CCS farm brings in $20,000–$50,000 per year at current efficiency levels, offering passive income from carbon credits and biochar sales. With projected improvements by 2030, the same setup could generate $500,000 or more annually, making it a compelling investment. The shift from ten modules per ton to just one will transform CCS farms into high-yield climate solutions.

4. Compatible with 45Q tax credits

Farmers could claim up to $180 per ton of CO2 removed, which adds to earnings from high-quality carbon credit sales. Biochar generated from the process sells for $200/ton, offering an additional stream of revenue. Together, these incentives position CCS as a compelling option for landowners looking to monetize environmental stewardship.

Why biochar-based CDR is winning the carbon credit race

As demand for real climate action grows, biochar is dominating carbon markets. In 2024, it made up 86% of CDR credit volume. Why? It’s proven, scalable, and has one killer advantage: offtake agreements.

Offtakes are multi-year deals that guarantee buyers future carbon credits at fixed prices. Think of them as carbon PPAs (power purchase agreements)—they de-risk investment and ensure long-term supply.

According to this offtake report, early buyers had already secured 62% of 2025 biochar supply and 24% of 2026 by the start of the year, highlighting the urgency to move quickly. CDR purchases grew 750% from 2022 to 2023, and that momentum isn’t slowing down—projections suggest the market could triple again by 2026 as more firms race to lock in credible credits.

>> In Other News: RepAir Raises $15 Million to Scale Electromechanical Carbon Capture Solution

Scaling CDR with algae and biochar

When CCS modules generate dried algae biomass, it can be converted into biochar through pyrolysis, creating a seamless link between algae farms and the rising demand for carbon-negative products. This makes such farms highly attractive for offtake buyers seeking reliable sources of scalable, verifiable carbon removal. With an upfront investment of $400,000 for a 1,000-module farm, and biochar fetching $200/ton—plus additional revenue from carbon credits and 45Q tax incentives—the return on investment becomes highly compelling as the market matures.

High-volume projects now dominate the CDR space, with the top five players accounting for nearly 79% of all carbon credits delivered in 2024, highlighting the growing concentration and maturity of this emerging sector.

The parallel to renewables

Biochar’s trajectory follows a familiar arc, much like the early days of solar and wind—initial skepticism was gradually replaced by investor confidence as scalable contracts proved the technology’s economic value. These offtake agreements have helped stabilize a previously volatile carbon market by locking in future demand. As a result, investors now have a clearer path to support large-scale carbon removal efforts.

And as BETH MCDANIEL puts it, "Scaling quickly isn't just a goal—it's the key to turning back the clock on climate change and giving us a fighting chance."

Who wins the CDR race?

There are three kinds of players in this space:

1. The early adopters with expert guidance

By locking in supply and securing favorable pricing, they gain a strategic edge—building diversified, high-integrity carbon portfolios that hold up under scrutiny and support long-term climate goals.

2. The fast followers

They enter the market quickly but often without the right guidance, risking the purchase of weaker credits or missing out on large-scale opportunities that yield long-term value.

3. The latecomers

They pay a premium—if they can get credits at all. As the global carbon market surges toward a projected $135 billion by 2034, access and affordability will become even more competitive. Companies that delay may find themselves priced out of the most credible, high-impact credits—if they’re available at all.

What’s next

The message is clear: CDR isn’t a sideshow anymore. Whether it’s algae-coated panels on a rooftop or pyrolyzed biochar under a cornfield, the new carbon economy is being built by those who scale first and partner smart.

And this time, there’s no second chance to be early.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

Sustaera's 3rd-Gen DAC Could Crack the $100/Ton Barrier

Inside This Issue 🧪 Sustaera's 3rd-Gen DAC Could Crack The $100/Ton Barrier ⚠️ Middle East Conflict Threatens To Derail The Region's Carbon Capture Boom 🌿 Svante And Integrated Packaging Company A...

-

PJM's AI Power Crisis Just Got a 250MW Hydrogen Answer

Inside This Issue ⚡ Plug Power Plans Hydrogen Offering in Top US Power-Grid Auction 🪨 Underground CO2 Storage, X-Rays Reveal Carbon Capture Capacity of Volcanic Rocks 🍁 Swiss Carbon Capture Compan...

-

One Montana Site Could Supply Half of North America's SAF

Inside This Issue ✈️ Montana's $1.44B Bet on Aviation Fuel Enters Final Stretch 🌍 Carbon Removal Coalition Forms With Goal of Attracting $100-Million in Project Investments 🤝 Prime Minister Carney...

Company Announcements

-

Next Hydrogen Secures Contracts Totaling $3.75 Million for Specialized Nuclear Application

MISSISSAUGA, Ontario -- Next Hydrogen Solutions Inc. (“Next Hydrogen” or the “Company”) is pleased to announce that it has been awarded two contracts with a combined value of approximately $3.75 mi...

-

Trafigura’s Morgen Energy Reaches Final Investment Decision for 20MW Green Hydrogen Project in Wales

Trafigura, a market leader in the global commodities industry, today announces that its wholly-owned subsidiary, MorGen Energy, has approved the final investment decision (FID) to begin constructio...

-

Chevron Lummus Global Expands Portfolio with Fischer-Tropsch Liquids Upgrading Solutions

Expansion strengthens hydroprocessing portfolio with proven technologies for upgrading FT derived liquid feedstock Chevron Lummus Global (CLG) announced the addition of Fischer-Tropsch (FT) liquid...

-

Ballard Announces Commercial Agreement With New Flyer For 50 MW Of Fuel Cell Bus Engines

VANCOUVER and WINNIPEG, CANADA – Ballard Power Systems (NASDAQ:BLDP; TSX:BLDP) today announced reaching a commercial agreement with New Flyer, a subsidiary of NFI Group Inc., (“NFI”; TSX:NFI; ), a ...