Google's Power Play: First CCS Deal Reshapes Energy

Published by Todd Bush on October 24, 2025

Google just made a move that could reshape how the tech industry powers its future. The company signed the first-ever corporate power purchase agreement for a natural gas plant with carbon capture and storage, marking a watershed moment for both AI infrastructure and climate technology.

The Broadwing Energy project in Decatur, Illinois will generate over 400 megawatts of clean power while capturing approximately 90% of its carbon emissions. Developed by Low Carbon Infrastructure (LCI), a portfolio company of infrastructure investor I Squared Capital, the facility represents a bold bet that carbon capture can deliver reliable, round-the-clock power at commercial scale.

"We've been really focused on advancing all these new technologies for around-the-clock clean technologies and this is an important piece of the puzzle. It's a very important technology that the world needs."

Michael Terrell, Head of Advanced Energy at Google

Why This Deal Matters

This isn't just another green energy headline. Google's agreement signals that tech giants are willing to underwrite new infrastructure models that combine firm power generation with emissions reduction. The deal addresses a critical challenge: AI data centers need electricity 24/7, and renewables alone can't always deliver that consistency.

The project will be built at an existing Archer Daniels Midland (ADM) industrial site in Decatur. ADM has operated carbon storage wells at the location since 2011, giving the Broadwing project access to proven sequestration infrastructure. The captured CO2 will be compressed and injected into EPA Class VI-approved wells more than a mile underground.

The Technology Behind the Project

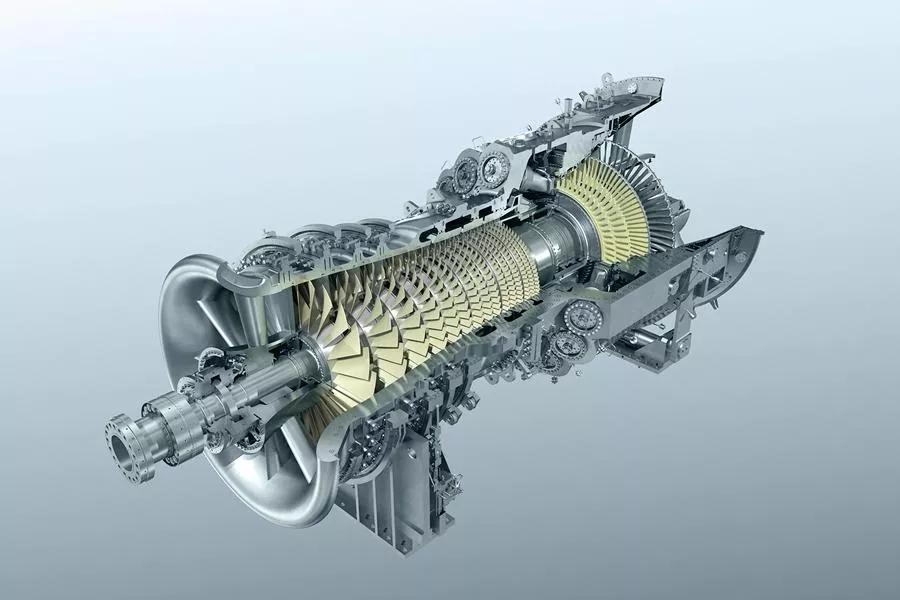

Broadwing Energy will use a Mitsubishi Power M501JAC gas turbine to generate electricity and more than 1.5 million pounds of steam per hour. The cogeneration design means ADM can use both the steam and some electricity for its processing operations, while Google purchases the majority of the power output for its regional data centers.

Kiewit Power Constructors will lead engineering, procurement, and construction services. The project financing is expected to reach final investment decision in Q2 2026, with commercial operations targeted for 2030.

Key Project Facts

- Capacity: 400+ megawatts of power generation

- Carbon Capture Rate: Over 90% of CO2 emissions

- Annual Sequestration: More than 2 million tons of CO2

- Construction Jobs: Approximately 650 union craft labor positions plus 100 management and support staff

- Timeline: Four-year construction period starting after Q2 2026 FID

- Target Operations: Early 2030

Commercial Viability Comes Into Focus

The Broadwing deal represents more than just a single project. It's the first in what Google and LCI envision as a pipeline of CCS-enabled facilities across North America. The partnership aims to prove that carbon capture can compete economically with other low-carbon generation technologies.

LCI acquired Warwick Carbon Solutions, the original developer of Broadwing Energy, earlier this year. The acquisition brought deep expertise in navigating the complex industrial and regulatory environment required for large-scale decarbonization projects.

"Broadwing demonstrates that carbon capture can be commercially viable today. Working alongside I Squared and Google, we're proving that low-carbon power can be both affordable and reliable, while driving job creation and community investment."

Jonathan Wiens, Chief Executive Officer of Low Carbon Infrastructure

Why Illinois Makes Strategic Sense

Location matters enormously for CCS projects, and Decatur offers several critical advantages. The geology beneath central Illinois features porous sandstone formations ideal for permanent CO2 storage. ADM's existing infrastructure eliminates years of permitting and regulatory hurdles that have stalled other carbon capture projects.

Illinois has emerged as a leader in carbon capture innovation, with state and local support enabling multiple demonstration projects. The region's industrial corridor, combined with access to the Midcontinent Independent System Operator (MISO) grid, positions Broadwing to serve both local industrial customers and broader electricity markets.

The Cogeneration Advantage

Broadwing's dual output of electricity and steam creates multiple revenue streams that improve project economics. ADM will purchase steam for its processing operations and has the option to buy electricity. Google will take the majority of power generation. This industrial symbiosis model could become a template for future CCS projects at manufacturing sites nationwide.

The arrangement addresses a persistent challenge in carbon capture economics: finding customers willing to pay premium prices for low-carbon energy. By combining industrial steam sales with a corporate power purchase agreement, Broadwing diversifies its revenue base and reduces financial risk.

>> In Other News: Asahi Kasei Expanding Capacity to Manufacture System Components for Clean Hydrogen

The Broader Context for Tech and Energy

Google's pivot toward CCS reflects mounting pressure on hyperscalers to secure reliable power for AI infrastructure while meeting climate commitments. The company's emissions have risen nearly 50% over the past five years, driven largely by data center expansion. Traditional renewables, while cost-effective, can't always match the 24/7 demand profile of AI computing.

The Broadwing agreement follows Google's investments in other advanced energy technologies, including enhanced geothermal, advanced nuclear, and long-duration energy storage. But natural gas with carbon capture offers something these alternatives don't: proven technology that can be deployed relatively quickly at scale.

CCS in the Power Sector: A Growing Trend

Several major energy companies have announced plans to integrate carbon capture with power generation:

- ExxonMobil has unveiled plans to build natural gas facilities with CCS for data centers, claiming 90% capture rates.

- Calpine and ExxonMobil partnered on the Baytown CCS Project in Texas, targeting 2 million metric tons of CO2 annually.

- Chevron, Engie, and GE Vernova formed a partnership to develop a 4-gigawatt natural gas plant with CCS technology by 2027.

Economic Impact and Job Creation

The Broadwing project is expected to generate substantial economic activity in central Illinois. Construction will create approximately 750 full-time jobs over four years, with 650 union craft labor positions and 100 construction management and support roles. Once operational, the facility will sustain dozens of permanent, well-paying positions.

Local officials have embraced the project as an opportunity to demonstrate leadership in energy transition technologies. The investment reinforces Decatur's position as a hub for industrial innovation and provides long-term infrastructure to support continued manufacturing growth in the region.

Transparency and Verification

One of the project's notable features is its commitment to rigorous emissions tracking. Broadwing will incorporate newly released standards for CCS-specific Energy Attribute Certificates (EACs), developed by industry experts to ensure carbon capture projects can be accurately quantified in emissions reporting.

This transparency framework addresses growing concerns about greenwashing in corporate energy procurement. By using verifiable certificates, Google can demonstrate the actual emissions impact of its power purchases rather than relying on estimates or offsets.

Challenges and Considerations

While the Broadwing announcement represents significant progress for CCS technology, several challenges remain. Carbon capture systems are capital-intensive, and achieving 90% capture rates requires careful engineering and ongoing operational excellence. The technology has faced scrutiny over costs, scalability, and long-term effectiveness.

ADM's existing Decatur facility has provided valuable lessons. The site has safely stored millions of tons of CO2 since operations began, though early performance fell short of initial projections. These learnings will inform Broadwing's design and operations, potentially improving capture rates and system reliability.

Infrastructure development, particularly CO2 pipelines, continues to face permitting delays and public opposition despite strong safety records. However, Broadwing benefits from using ADM's existing sequestration wells, avoiding the need for new pipeline construction in the project's initial phase.

Industry Implications and Next Steps

The Google-LCI partnership could catalyze broader adoption of CCS-enabled power generation. Other hyperscalers facing similar energy constraints are watching closely. Meta is reportedly exploring carbon capture integration for its Louisiana data center complex, while Microsoft has made substantial commitments to carbon removal technologies.

For the carbon capture industry, the deal provides validation that corporate offtakers are willing to support commercial-scale projects. This demand signal could unlock additional private investment in CCS infrastructure, accelerating deployment across industrial sectors.

| Milestone | Target Date | Details |

|---|---|---|

| Final Investment Decision | Q2 2026 | Project financing and construction approval |

| Construction Start | Mid-2026 | Four-year construction timeline begins |

| Commercial Operations | Early 2030 | Full power generation and CO2 capture begins |

| Additional Projects | TBD | Google and LCI to pursue pipeline of CCS facilities |

What This Means for Decarbonization

The Broadwing project represents a pragmatic approach to emissions reduction that acknowledges current technological and economic realities. Natural gas with carbon capture won't replace renewables, but it addresses the intermittency challenge that has limited wind and solar deployment in certain applications.

For industries requiring constant, high-volume power, CCS-enabled gas generation offers a bridge solution. The technology allows continued use of abundant domestic natural gas resources while dramatically reducing emissions. If costs decline as the technology scales, this model could accelerate industrial decarbonization across sectors like steel, cement, and chemicals.

Google's involvement brings credibility and capital to a technology that has struggled to achieve commercial traction. The company's commitment to transparency and rigorous measurement could establish new standards for how CCS projects are evaluated and reported. As more projects move from concept to operation, the industry will gain critical data on real-world performance and economics.

The Road Ahead

Broadwing Energy faces a multi-year journey from announcement to operation. The project must navigate financing, detailed engineering, permitting, and construction before delivering its first kilowatt-hour. Success will depend on execution across numerous technical, regulatory, and commercial dimensions.

If Broadwing achieves its goals, it could unlock a new category of clean energy investment. The combination of corporate offtake agreements, proven storage infrastructure, and advanced generation technology creates a replicable model. Other sites with similar characteristics could attract development, creating a distributed network of CCS-enabled facilities.

The partnership between Google, I Squared Capital, and Low Carbon Infrastructure demonstrates how different sectors can collaborate on climate solutions. Tech companies bring long-term energy demand and sustainability commitments. Infrastructure investors provide patient capital and project development expertise. Together, they're building the foundation for reliable, lower-carbon power that can support economic growth while addressing climate change.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Latest issues

-

What Do Submarines Have to Do With Hydrogen?

Inside This Issue 🚢 Hyundai Pitches Hydrogen Transport Tied To Canada Submarine Bid 🧱 The LEGO Group Expands Its Portfolio Of Carbon Removal Solutions 🏆 SAF Pioneer LanzaJet Honored With RFA Indus...

-

This $4.1M Deal Could Change Carbon Capture's Playbook

Inside This Issue 🗜️ CarbonQuest Lands $4.1M Alberta Deal on Gas Compressors 🛡️ CADO, 123Carbon, and Assure SAF Registry Join Forces to Tackle SAF Integrity Gaps ✈️ ISCC, OMV, and Airbus Partner t...

-

Can Koloma Crack Iowa's Billion-Year-Old Secret?

Inside This Issue ⛏️ Iowa's Hydrogen Rush: Can Koloma Strike Gold Before Rules Kick In? ✈️ Bentley Commits to Use 100% Sustainable Aviation Fuel for Car Airfreight 🌬️ Minister Parrott Provides Upd...

Company Announcements

-

CHIFENG, China, Feb. 27, 2026 /PRNewswire/ -- Envision Energy launched the first global shipment of green ammonia from Chifeng, Inner Mongolia to LOTTE Fine Chemical, a premier chemical company in ...

-

SAF Pioneer LanzaJet Honored With RFA Industry Award

Pioneering sustainable aviation fuel producer LanzaJet received the Renewable Fuels Association’s 2026 Industry Award at the National Ethanol Conference in Orlando this week. Last year the company ...

-

Houston Hosts World Hydrogen North America 2026 Industry Gathering

Hydrogen is one of the energy sources that has evolved the most when it comes to how developers plan and execute projects. The main reason for this is the advanced technology that has penetrated th...

-

Trump EPA Eyes Reallocating Waived Biofuel Obligations To Refiners: Report

The question of whether to reallocate those exempted blending obligations to larger refiners is a point of contention between the agriculture and fuel industries The Trump administration has settl...