Federal tax policy is directing billions in direct air capture funding toward enhanced oil recovery, with industry leaders committing to rigorous monitoring standards. The 45Q tax credit creates different incentive pathways for permanent storage versus utilization projects, while companies pursue comprehensive measurement, reporting, and verification programs to validate carbon removal claims.

Key Policy Numbers

- $36/ton: 45Q credit for DAC with permanent storage

- $26/ton: 45Q credit for DAC with EOR utilization

- $500 million: DOE award to 1PointFive for South Texas DAC hub

- 500,000 tons/year: Capacity of Occidental's STRATOS facility

- 3,000+: CO2 injection wells operated by Occidental for EOR

How 45Q Tax Credits Shape Investment Flows

The federal 45Q tax credit creates different incentive structures that influence where DAC investments flow. Under current rates, direct air capture projects earn $36 per metric ton for permanent geologic storage, compared to $26 per metric ton when captured CO2 supports enhanced oil recovery. However, EOR projects often provide faster revenue streams and lower technical risks compared to permanent storage projects. Companies can sell the captured CO2 to oil producers immediately, while permanent storage requires extensive permitting, site preparation, and long-term monitoring. Key factors driving investment decisions include:

- Faster project timelines for EOR applications

- Established CO2 transport infrastructure in oil-producing regions

- Immediate revenue from CO2 sales versus future tax credit payments

- Lower regulatory barriers compared to Class VI injection wells

>> RELATED: Direct Air Capture: The Technology Racing to Scale Carbon Removal

Industry Commitments to Carbon Measurement

Leading companies are investing heavily in monitoring, reporting, and verification systems to ensure DAC carbon removal projects deliver measurable climate benefits. These comprehensive tracking programs address concerns about carbon permanence while building industry standards for transparent accounting. Major operators have implemented EPA-approved monitoring plans and third-party verification protocols. The rigorous measurement requirements help distinguish between temporary CO2 utilization and permanent carbon removal, supporting long-term decarbonization objectives.

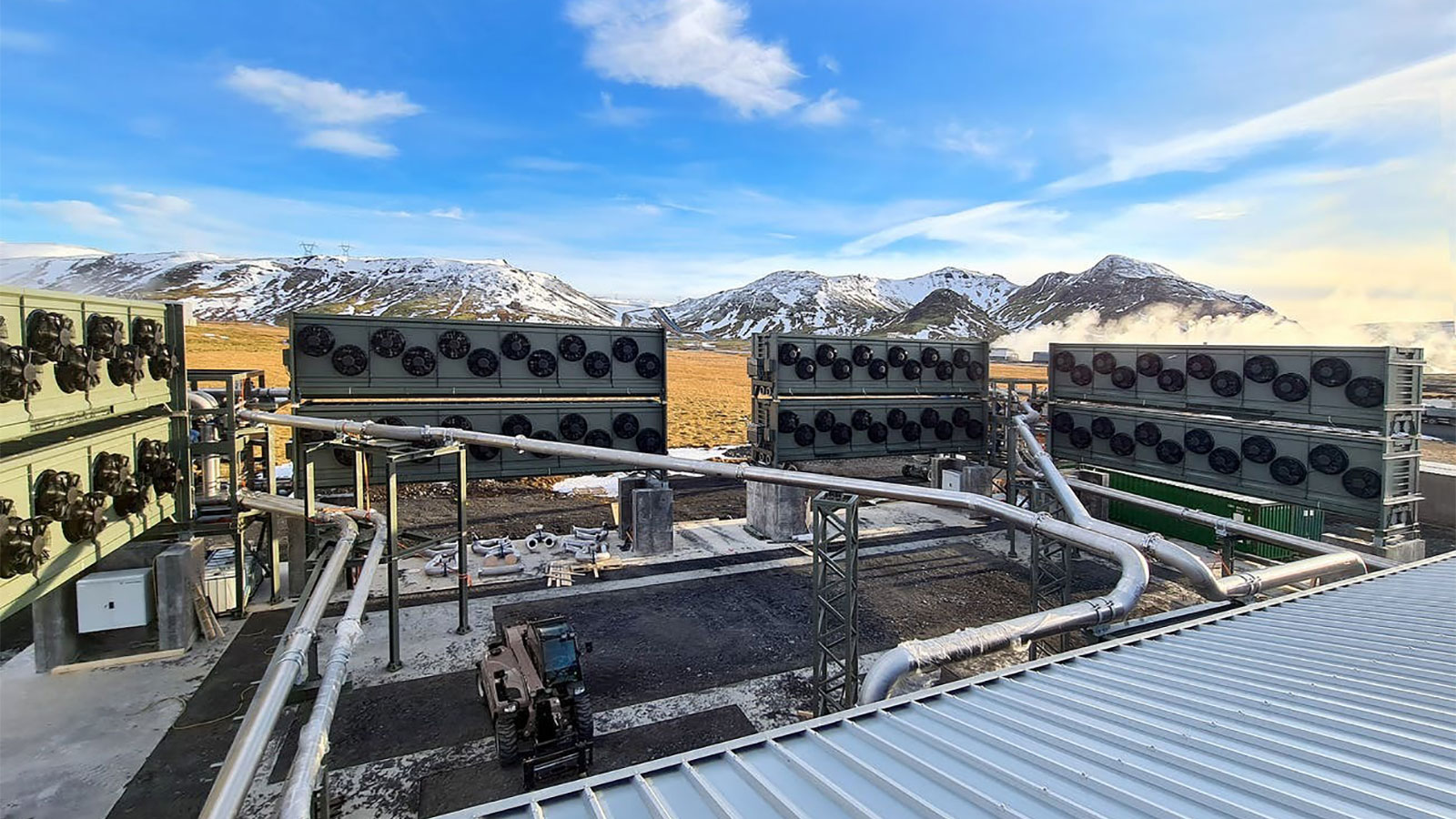

Major Projects Mixing DAC and Oil Recovery

Occidental Petroleum has emerged as the dominant player linking DAC technology with enhanced oil recovery operations. The company's 1PointFive subsidiary received up to $500 million from the Department of Energy for a South Texas DAC hub that will combine carbon removal with EOR applications.

"We appreciate the U.S. Department of Energy's leadership to advance Direct Air Capture and look forward to our partnership to deploy this vital carbon removal technology at climate-relevant scale."

Vicki Hollub, President and CEO, Occidental Petroleum

The company operates over 3,000 CO2 injection wells for EOR, nearly four times more than its closest competitor. This existing infrastructure creates natural synergies between DAC operations and oil recovery activities. Current DAC projects with EOR components include:

- STRATOS facility in West Texas, targeting 500,000 tons annually by 2025

- South Texas DAC Hub on King Ranch, designed for up to 1 million tons per year

- Planned expansion to 30 million tons annually across multiple facilities

Technical Differences in Carbon Storage

The permanence of carbon removal depends significantly on storage methodology, according to IRS guidance on lifecycle accounting. Permanent geologic storage targets indefinite CO2 retention, while EOR operations face requirements to verify net carbon benefits through comprehensive lifecycle analysis. Federal regulations require different monitoring approaches for various storage types. Projects must demonstrate compliance with EPA Underground Injection Control regulations and provide detailed reporting under 40 CFR Part 98 subpart RR requirements.

"Direct air capture technologies are promising but speculative. Their prospect as an affordable negative emissions option that can be deployed in large scale remains uncertain."

Dr. David Reiner, Energy Policy Research Group, University of Cambridge

Measurement, reporting, and verification (MRV) requirements also differ substantially:

- Permanent storage requires extensive monitoring for decades

- EOR projects focus on production optimization rather than climate impact

- Life-cycle analysis must account for emissions from extracted oil

>> In Other News: Sweetwater Carbon Storage Hub Completes Deepest Carbon Storage Well in the Nation

Policy Solutions to Preserve Durable Removal Incentives

Potential policy adjustments could maintain support for carbon removal while limiting incentives that expand fossil fuel production. These modifications would require careful balance to avoid undermining legitimate climate benefits while preventing counterproductive outcomes. Three practical policy fixes could address current concerns:

- Establish permanence requirements: Require DAC projects receiving federal funding to demonstrate net-negative emissions over full project lifecycles, accounting for any fossil fuel extraction enabled by captured CO2 (precedent: California's Low Carbon Fuel Standard permanence requirements).

- Create separate credit rates: Implement tiered 45Q credits based on storage permanence and additionality criteria, with highest rates reserved for verified permanent storage projects (precedent: Renewable Energy Certificate differentiation by technology type).

- Mandate lifecycle accounting: Require EOR-linked DAC projects to subtract downstream emissions from oil combustion when calculating net carbon removal benefits (precedent: EPA's greenhouse gas reporting program methodology).

What to Watch

- IRS 45Q guidance updates (expected Q4 2025): Treasury may clarify permanence requirements and lifecycle accounting standards for DAC projects receiving tax credits

- DOE hub project awards (ongoing through 2026): Four regional DAC hubs will demonstrate different approaches to carbon storage, providing real-world data on EOR versus permanent storage outcomes

- EPA Class VI permitting (2025-2027): Approval timelines for permanent storage permits will influence whether projects choose EOR alternatives for faster deployment

Verification Note:

Current 45Q rates confirmed through IRS Form 8933 instructions. DAC facility rates are $36/ton for permanent storage and $26/ton for EOR/utilization as of 2024.

Sources

- 45Q Tax Credit Rates: IRS Form 8933 Instructions for Carbon Oxide Sequestration Credit

- 1PointFive DOE Grant: Occidental Press Release, August 11, 2023

- DOE DAC Hubs Program: U.S. Department of Energy Office of Clean Energy Demonstrations

- Carbon Engineering Technology: Direct Air Capture Company Website

- Expert Analysis: Future Prospects of Direct Air Capture Technologies, Frontiers in Climate

- EPA Reporting Requirements: 40 CFR Part 98 Subpart RR Guidance

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Companies

Latest issues

-

What Do Submarines Have to Do With Hydrogen?

Inside This Issue 🚢 Hyundai Pitches Hydrogen Transport Tied To Canada Submarine Bid 🧱 The LEGO Group Expands Its Portfolio Of Carbon Removal Solutions 🏆 SAF Pioneer LanzaJet Honored With RFA Indus...

-

This $4.1M Deal Could Change Carbon Capture's Playbook

Inside This Issue 🗜️ CarbonQuest Lands $4.1M Alberta Deal on Gas Compressors 🛡️ CADO, 123Carbon, and Assure SAF Registry Join Forces to Tackle SAF Integrity Gaps ✈️ ISCC, OMV, and Airbus Partner t...

-

Can Koloma Crack Iowa's Billion-Year-Old Secret?

Inside This Issue ⛏️ Iowa's Hydrogen Rush: Can Koloma Strike Gold Before Rules Kick In? ✈️ Bentley Commits to Use 100% Sustainable Aviation Fuel for Car Airfreight 🌬️ Minister Parrott Provides Upd...

Company Announcements

-

CHIFENG, China, Feb. 27, 2026 /PRNewswire/ -- Envision Energy launched the first global shipment of green ammonia from Chifeng, Inner Mongolia to LOTTE Fine Chemical, a premier chemical company in ...

-

SAF Pioneer LanzaJet Honored With RFA Industry Award

Pioneering sustainable aviation fuel producer LanzaJet received the Renewable Fuels Association’s 2026 Industry Award at the National Ethanol Conference in Orlando this week. Last year the company ...

-

Houston Hosts World Hydrogen North America 2026 Industry Gathering

Hydrogen is one of the energy sources that has evolved the most when it comes to how developers plan and execute projects. The main reason for this is the advanced technology that has penetrated th...

-

Trump EPA Eyes Reallocating Waived Biofuel Obligations To Refiners: Report

The question of whether to reallocate those exempted blending obligations to larger refiners is a point of contention between the agriculture and fuel industries The Trump administration has settl...