The aviation industry has been waiting since 2016 for this moment. LanzaJet just flipped the switch on something that changes everything about how we power planes. Their Freedom Pines Fuels facility in Soperton, Georgia isn't another pilot project or tech demo. It's a fully operational, commercial-scale plant producing ASTM-certified jet fuel from ethanol, and it's the first of its kind on the planet. More importantly, it's the world's first non-oil-based renewable jet fuel solution compatible with today's aircraft.

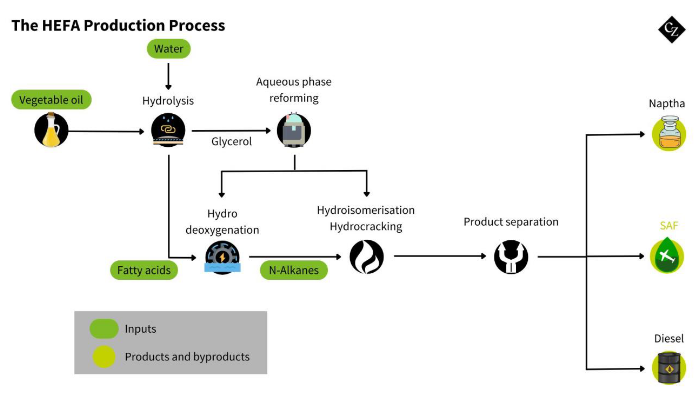

This matters because traditional sustainable aviation fuel production has been hitting a wall. The industry's been relying on HEFA pathways (hydroprocessed esters and fatty acids) using waste cooking oil, animal fats, and vegetable oils to make SAF. Even though these are waste streams, they're still oil-based and there's only so much of that to go around. LanzaJet's alcohol-to-jet technology just broke free from that entirely, unlocking a completely different feedstock pool: agricultural waste, municipal trash, energy crops, and even captured carbon dioxide. That's a game changer for scaling SAF globally.

Breaking the Feedstock Bottleneck

The HEFA pathway (hydroprocessed esters and fatty acids) has been the go-to method for SAF production, but it's running into serious supply constraints. Used cooking oil, animal fats, and vegetable oils can only scale so far before you start competing with other industries or pushing into unsustainable territory. More fundamentally, these are all still lipid-based, oil-derived feedstocks with inherent limitations.

LanzaJet's breakthrough is producing the first non-oil-based renewable jet fuel compatible with existing aircraft. Ethanol can be produced from almost anything organic, breaking the dependency on fats and oils entirely. We're talking corn stover, wood chips, agricultural residues, municipal solid waste, industrial off-gases, and captured CO₂ combined with hydrogen from regional hubs. This flexibility means countries everywhere can produce SAF using their own local resources instead of fighting over limited feedstocks.

With the bio-oil HEFA pathway expected to near a plateau in available and qualified feedstocks, LanzaJet's Alcohol-to-Jet technology has unlocked the next wave of SAF production applicable to nearly all regions throughout the world.

LanzaJet Freedom Pines Fuels

From Lab Bench to Commercial Reality

The journey to Freedom Pines represents 15 years of research and development, collaboration, investment, and scale-up. It started back in 2012 when LanzaTech partnered with the U.S. Department of Energy's Pacific Northwest National Laboratory. What followed was over a decade of lab work, pilot plants, demonstration facilities, and countless iterations. The technology got ASTM approval in 2016, allowing ethanol-based SAF to be blended with conventional jet fuel. Virgin Atlantic and All Nippon Airways flew the first commercial flights using this fuel in 2018 and 2019.

But getting regulatory approval is one thing. Proving you can make it work at commercial scale is something else entirely. That's what Freedom Pines just accomplished, making it one of the most promising technologies in nearly a decade to reach commercial readiness. The facility integrated multiple first-of-a-kind technologies, including Technip Energies' Hummingbird technology for ethanol-to-ethylene conversion and an oligomerization process developed jointly by the DOE and LanzaTech. LanzaJet successfully troubleshot and brought into operation this fully integrated First-of-a-Kind plant, creating a blueprint for future SAF production worldwide.

"Today proves what happens when you bring together innovation, resilience, ingenuity, and teamwork to think big and develop a new industry, overcome challenges, and enable global growth. Our story at LanzaJet is one of impact – building a new industry, creating value, and delivering on our commitments regardless of obstacles in our way. We're now in a unique position with technology and operational know-how to shape this global industry in the decade ahead."

Jimmy Samartzis, Chief Executive Officer of LanzaJet

Why This Technology Matters for Energy Security

Here's what makes the alcohol-to-jet pathway different from other SAF technologies: it turns ethanol into a strategic connector between diverse domestic feedstocks and aviation fuel markets. Countries can now leverage their own agricultural sectors, waste streams, and carbon capture infrastructure to produce jet fuel.

Think about what that means. A nation with lots of agricultural waste can convert it into ethanol, then into jet fuel. A country investing heavily in direct air capture can use captured CO₂ combined with green hydrogen to make ethanol, then SAF. Cities with municipal solid waste problems can turn trash into aviation fuel. The feedstock flexibility is what makes this scalable in a way that HEFA never could be.

How the ATJ Process Works

The alcohol-to-jet process isn't simple, but the basic flow goes like this:

1. Feedstock to Ethanol: Agricultural residues, waste, or captured carbon get converted into ethanol using various proven processes.

2. Ethanol to Ethylene: The ethanol is dehydrated to produce ethylene using specialized catalytic technology.

3. Oligomerization: Ethylene molecules are combined to form longer hydrocarbon chains.

4. Hydroprocessing: The hydrocarbons are refined and finished to meet jet fuel specifications.

5. Blending: The final product gets blended with conventional Jet A-1 fuel and is fully certified for use in existing aircraft without any modifications.

The beauty of this process is that it can convert 98% of the carbon in ethanol into high-value hydrocarbon products. You get roughly 90% SAF and 10% renewable diesel, and that ratio can be adjusted based on market demand.

The Global Rollout Plan

Freedom Pines isn't a one-off. LanzaJet is already working on multiple projects worldwide. Project Speedbird in the UK will produce over 90,000 tonnes (30 million U.S. gallons) of SAF annually. There are active projects in Australia, Japan, India, Colombia, the European Union, the Middle East, and Kazakhstan.

The company's goal is ambitious: 1 billion gallons of SAF production capacity by 2030. That might sound like a lot, but when you consider that U.S. aviation alone consumed about 18 billion gallons of jet fuel in 2023, you realize just how much work remains to truly decarbonize the sector.

| SAF Pathway | Primary Feedstocks | Scalability Potential |

|---|---|---|

| HEFA (Hydroprocessed Esters & Fatty Acids) | Used cooking oil, animal fats, vegetable oils | Limited - feedstock constraints |

| Alcohol-to-Jet (ATJ) | Agricultural waste, municipal solid waste, captured CO₂, energy crops | High - diverse and abundant feedstocks |

| Fischer-Tropsch | Biomass gasification, municipal waste | Medium - requires gasification infrastructure |

| Power-to-Liquid | Renewable electricity, captured CO₂, water | High - but energy intensive and costly |

Why the Department of Energy Bet Big on This

The DOE has been backing Freedom Pines since 2016 through its Bioenergy Technology Office. Their investment wasn't just about funding another clean energy project. It was about validating an entire technology pathway at commercial scale.

Dr. Mark Shmorhun, the BETO Technology Manager overseeing the project, explained why this matters: small-scale demonstrations can prove a technology works, but they don't prove it can be built and operated profitably at commercial scale. Freedom Pines validates all the engineering assumptions, cost projections, supply chain logistics, and operating parameters that future facilities will need.

"There have been numerous examples of much smaller scale technology demonstrations of alcohol-to-jet, but this is the one where you validate all your engineering assumptions to see if you're meeting key performance targets. That in turn validates your cost of production and your operating cost."

Dr. Mark Shmorhun, BETO Technology Manager for Systems Development and Integration, U.S. Department of Energy

The facility also plays into the DOE's SAF Grand Challenge, launched in 2021 alongside the Department of Transportation and USDA. The goal is to produce 3 billion gallons of SAF annually by 2030 and meet 100% of U.S. aviation fuel demand with SAF by 2050. Freedom Pines alone won't get us there, but it proves the technology pathway that could.

The Economics That Make This Work

SAF has always faced an economics problem. It costs more to produce than conventional jet fuel, which means airlines won't buy it at scale unless there are incentives or mandates. That's where policy comes in.

The Inflation Reduction Act's 45Z Clean Fuel Production Tax Credit provides 35 cents per gallon for SAF, giving producers breathing room to scale up. Several states have their own incentive programs. And as carbon capture infrastructure expands, the potential to use captured CO₂ as a feedstock becomes more attractive.

LanzaJet secured offtake agreements for the next ten years, which means they've got customers lined up to buy the fuel. Major airlines including All Nippon Airways, British Airways, and Southwest Airlines are investors in the company, which tells you they're serious about securing SAF supply.

>> In Other News: CleanCounts Affirms Commitment to Nuclear in Energy Tracking

What This Means for Rural Communities

One aspect that doesn't get enough attention: the economic development angle for rural America and agricultural communities worldwide. Freedom Pines is located in Treutlen County, Georgia, a rural area that benefited from 300+ construction jobs and now has 65+ permanent positions. The facility generates $5 million in new wages and benefits annually, with a total economic impact of $70 million per year.

This pattern can repeat across the country and around the world. LanzaJet's technology provides opportunities for countries to reinforce and expand their agriculture sectors by accessing new markets for ethanol production. Rural areas with agricultural waste or energy crops can host ATJ facilities, creating manufacturing jobs and new revenue streams for farmers. It's economic development tied directly to decarbonization and enhanced domestic energy security, which makes it politically durable across different administrations.

The Bigger Picture for Aviation Decarbonization

Aviation accounts for about 2% of global CO₂ emissions, but it's one of the hardest sectors to decarbonize. Electric planes work for short regional flights, but long-haul aviation needs the energy density that only liquid fuels can provide. That means sustainable aviation fuel isn't just nice to have, it's essential.

The industry has set aggressive targets. The International Air Transport Association (IATA) projects that SAF needs to account for 65% of the emissions reductions required to hit net-zero by 2050. Airlines have committed to flying on 10% SAF by 2030. Meeting those goals requires scaling production by orders of magnitude.

Freedom Pines proves one pathway to get there. It shows that ethanol-to-jet works at commercial scale, producing on-spec fuel that aircraft can use today without modifications. That's the kind of proof point investors and policymakers need to see before committing billions to build out the infrastructure.

What Comes Next

The next phase is optimization and replication. LanzaJet will continue refining operations at Freedom Pines to improve efficiency and reduce costs. Data from the facility will inform the design of second and third-generation plants, which should be faster and cheaper to build.

The technology is also being deployed internationally. Project Speedbird in the UK, backed by British Airways and using Nova Pangaea Technologies' process to convert woody waste into ethanol, represents the next generation. Similar projects are moving forward in Japan, India, and Australia.

Meanwhile, the policy landscape will be critical. Continuation of the 45Z tax credit and state-level incentives will determine how quickly SAF production can scale. Class VI well permits for CO₂ storage will affect the economics of using captured carbon as a feedstock. Infrastructure development for collecting and transporting diverse feedstocks will either enable or constrain growth.

The Path Forward

LanzaJet Freedom Pines represents more than just another SAF facility coming online. It's a critical breakthrough that provides evidence ethanol can be transformed into jet fuel at commercial scale, solving the feedstock bottleneck plaguing traditional SAF production. By proving that ethanol from diverse sources can be converted into ASTM-certified, non-oil-based jet fuel compatible with existing aircraft, it opens the door for a truly global rollout.

The aviation industry has been waiting nine years since ASTM approved the alcohol-to-jet pathway in 2016. Now they've got proof it works at commercial scale. The question isn't whether ATJ technology can produce SAF anymore. The question is how fast the industry can build the infrastructure, secure the feedstocks, and scale production to meet the ambitious targets airlines have set.

With Freedom Pines operational and serving as a blueprint for future facilities in development worldwide, that scaling process just accelerated. Airlines finally have the proven technology pathway they've been waiting for.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Companies

Latest issues

-

What Do Submarines Have to Do With Hydrogen?

Inside This Issue 🚢 Hyundai Pitches Hydrogen Transport Tied To Canada Submarine Bid 🧱 The LEGO Group Expands Its Portfolio Of Carbon Removal Solutions 🏆 SAF Pioneer LanzaJet Honored With RFA Indus...

-

This $4.1M Deal Could Change Carbon Capture's Playbook

Inside This Issue 🗜️ CarbonQuest Lands $4.1M Alberta Deal on Gas Compressors 🛡️ CADO, 123Carbon, and Assure SAF Registry Join Forces to Tackle SAF Integrity Gaps ✈️ ISCC, OMV, and Airbus Partner t...

-

Can Koloma Crack Iowa's Billion-Year-Old Secret?

Inside This Issue ⛏️ Iowa's Hydrogen Rush: Can Koloma Strike Gold Before Rules Kick In? ✈️ Bentley Commits to Use 100% Sustainable Aviation Fuel for Car Airfreight 🌬️ Minister Parrott Provides Upd...

Company Announcements

-

CHIFENG, China, Feb. 27, 2026 /PRNewswire/ -- Envision Energy launched the first global shipment of green ammonia from Chifeng, Inner Mongolia to LOTTE Fine Chemical, a premier chemical company in ...

-

SAF Pioneer LanzaJet Honored With RFA Industry Award

Pioneering sustainable aviation fuel producer LanzaJet received the Renewable Fuels Association’s 2026 Industry Award at the National Ethanol Conference in Orlando this week. Last year the company ...

-

Houston Hosts World Hydrogen North America 2026 Industry Gathering

Hydrogen is one of the energy sources that has evolved the most when it comes to how developers plan and execute projects. The main reason for this is the advanced technology that has penetrated th...

-

Trump EPA Eyes Reallocating Waived Biofuel Obligations To Refiners: Report

The question of whether to reallocate those exempted blending obligations to larger refiners is a point of contention between the agriculture and fuel industries The Trump administration has settl...