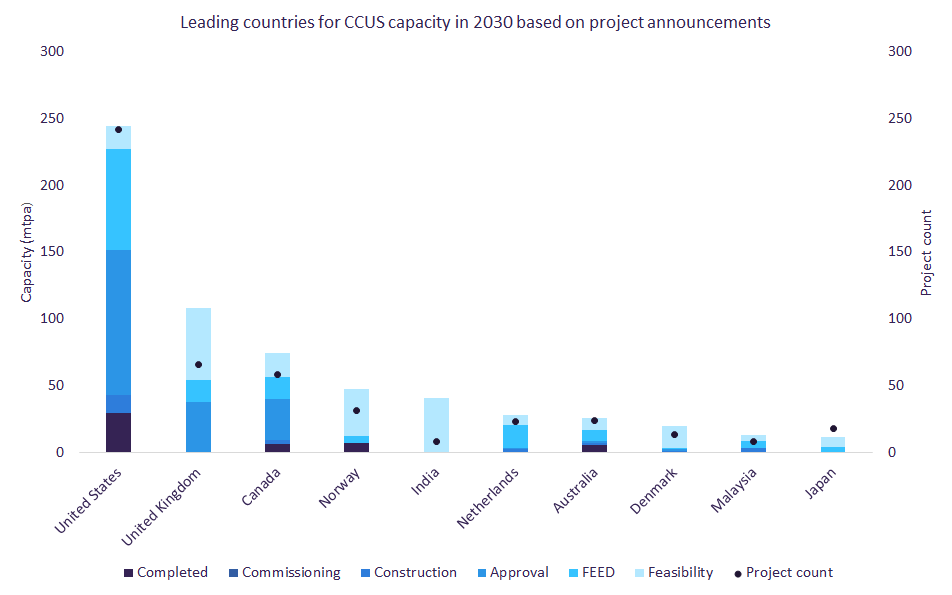

Carbon Capture, Utilization, and Storage (CCUS) is rapidly emerging as a pivotal technology in the global effort to combat climate change. According to GlobalData's CCUS Market Outlook and Trends H1 2025 report, global CCUS capacity is projected to reach 735 million tonnes per annum (mtpa) by 2030.

This ambitious growth is spearheaded by key players across various countries. Let's delve into the top companies propelling CCUS initiatives worldwide.

>> RELATED: Pioneering the Future: Companies Leading the Charge in BECCS Technology

1. United States: Pioneering CCUS Innovations

The United States stands at the forefront with an anticipated 244.77mtpa of CCUS capacity across 266 projects by 2030. This impressive figure is largely attributed to industry giants such as:

- ExxonMobil: Leading significant projects like the Baytown Refinery CCS Project in Texas.

- Prairie State Generating Company: Driving the Prairie State Energy Power Plant CCS Project in Illinois.

These companies are leveraging robust policy frameworks and financial incentives, including the Inflation Reduction Act and the Infrastructure Investment and Jobs Act, to advance their CCUS endeavors.

2. United Kingdom: Ambitious Climate Strategies

The United Kingdom is making substantial strides with a projected 107.93mtpa of CCUS capacity across 75 projects by 2030. Notable contributors include:

- Drax Group: Spearheading the Drax BECCS (Bioenergy with Carbon Capture and Storage) power plant in North Yorkshire.

- Sumitomo Corporation: Developing the Bacton Hydrogen Hub CCS project in Norfolk.

These initiatives align with the UK's commitment to integrating CCUS into its industrial decarbonization and broader climate strategies.

3. Canada: Early Adoption and Continued Growth

Canada has been a proactive adopter of CCUS technologies, with an expected 74.49mtpa of capacity from 62 projects by 2030. Key players driving this growth are:

- Shell Canada: Engaged in multiple CCUS projects across the country.

- Petro-Canada: Investing in carbon capture solutions to reduce emissions.

Canada's leadership in carbon pricing and substantial financial commitments underscore its dedication to CCUS development.

>> In Other News: Air Products, Air Liquide Signal Cooling of Hydrogen Enthusiasm

4. Norway: European CCUS Leader

Norway is set to achieve 47.74mtpa of CCUS capacity from 39 projects by 2030. A standout initiative is the Northern Lights CO₂ Storage Project, a collaboration between:

- Equinor: A major force in the energy sector.

- Shell: Bringing extensive experience in carbon capture.

- TotalEnergies: Contributing to the project's development.

This project represents the world's first cross-border CO₂ transport and storage facility, highlighting Norway's leadership in European CCUS efforts.

5. India: Emerging CCUS Market

India is rapidly emerging in the CCUS landscape, with a planned capacity of 40.71mtpa across ten projects by 2030. A significant contributor is:

- Synergia Energy: Leading the Cambay storage project, poised to be a major player in India's carbon capture initiatives.

The Indian government's proposed CCUS policies aim to foster industry clusters and provide financial incentives to achieve ambitious capacity targets.

6. The Netherlands: Comprehensive CCUS Policies

The Netherlands is projected to reach 27.69mtpa in CCUS capacity across 26 projects by 2030. Companies at the forefront include:

- Royal Dutch Shell: Actively involved in various CCUS projects.

- Equinor: Partnering in initiatives to enhance carbon capture capabilities.

The Dutch government's supportive policies and funding opportunities have been instrumental in advancing CCUS projects.

7. Australia: Incentivizing CCUS Development

Australia anticipates a total CCUS capacity of 25.37mtpa from 30 projects by 2030. Leading entities include:

- Santos Limited: Investing in carbon capture projects to mitigate emissions.

- Chevron Australia: Operating significant CCUS initiatives in the region.

Government incentives and funding have played a crucial role in promoting CCUS technologies across the country.

8. Denmark: Steady Progress in CCUS

Denmark is forecasted to have 19.54mtpa in CCUS capacity from 13 projects by 2030. Key participants are:

- Ørsted: Engaging in projects aimed at reducing carbon emissions.

- TotalEnergies: Collaborating on CCUS developments within the country.

Both domestic and EU-level support have facilitated Denmark's steady progress in CCUS initiatives.

9. Malaysia: Strategic CCUS Hubs

Malaysia is expected to achieve 13.3mtpa in CCUS capacity across nine projects by 2030. Notable companies include:

- Petronas: Leading efforts in developing CCUS hubs and infrastructure.

- Mubadala Petroleum: Partnering in projects to enhance carbon capture capabilities.

The Malaysian government's strategic roadmap and incentives are pivotal in advancing CCUS projects.

10. Japan: Laying the Groundwork for CCUS

Japan rounds out the list with a projected 11.52mtpa of CCUS capacity from 21 projects by 2030. Prominent contributors are:

- Mitsubishi Heavy Industries: Developing advanced carbon capture technologies.

- JGC Holdings Corporation: Participating in various CCUS projects to reduce emissions.

Japan's forward-looking policies and significant investments are establishing a strong foundation for CCUS development.

In summary, these companies are at the vanguard of the global CCUS movement, each playing a crucial role in their respective countries to combat climate change through innovative carbon capture solutions.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Companies

Latest issues

-

Canada Nickel Just Buried CO₂ Before Mining Even Started

Inside This Issue ⛏️ Canada Nickel And UT Prove Mining Can Fight Climate Change 🛰️ OGCI And Carbon Mapper Team Up To Reduce Methane Emissions From The Oil And Gas Sector 🚛 RNG Continues To Lead As...

-

96% Pure H₂ Found Underground — Now What?

Inside This Issue 🧪 HyTerra's Kansas H₂ Could Power a Historic Industry First 🤝 Prime Minister Carney Secures Ambitious New Partnership With India Focused on Energy, Talent, and Technology Françai...

-

What Do Submarines Have to Do With Hydrogen?

Inside This Issue 🚢 Hyundai Pitches Hydrogen Transport Tied To Canada Submarine Bid 🧱 The LEGO Group Expands Its Portfolio Of Carbon Removal Solutions 🏆 SAF Pioneer LanzaJet Honored With RFA Indus...

Company Announcements

-

OGCI And Carbon Mapper Team Up To Reduce Methane Emissions From The Oil And Gas Sector

OGCI, Carbon Mapper collaboration combines public satellite methane data and science-driven strategy with industry-led engagement. Mitigating methane emissions is one of the fastest and most effec...

-

NEWPORT BEACH, Calif.--(BUSINESS WIRE)--Clean Energy Fuels Corp. (NASDAQ: CLNE), the largest provider of the cleanest fuel for the transportation market, has announced a slew of deals with trucking...

-

MENLO PARK, Calif., March 4, 2026 /PRNewswire/ -- Mainspring Energy Inc. today announced that it has been awarded a contract by the United States Department of the Air Force (DAF) for a pilot progr...

-

Plug Power Welcomes Jose Luis Crespo as Chief Executive Officer

Crespo’s commercial and operational expertise positions Plug for disciplined growth and execution SLINGERLANDS, N.Y., March 03, 2026 (GLOBE NEWSWIRE) -- Plug Power Inc. (NASDAQ: PLUG), a global le...