The U.S. Department of Energy's cancellation of 19 out of 21 direct air capture hub awards has sent shockwaves through the carbon removal industry. At the same time, the Global CCS Institute reported a stunning 54% increase in operational carbon capture projects worldwide.

This stark contrast raises a critical question: can carbon removal technologies thrive without federal backing, or are we witnessing a fundamental shift in where decarbonization progress will happen?

Key Facts: U.S. DAC Funding Cuts

- 19 of 21 projects from the original DAC hubs program face termination

- $1.2 billion in potential federal funding at risk for Project Cypress and South Texas DAC Hub

- Only two small feasibility grants remain active as of October 2025

- $3.5 billion originally allocated under the Bipartisan Infrastructure Law

The DOE Pullback: What's Being Lost

The Bipartisan Infrastructure Law set aside $3.5 billion to create four regional, commercial-scale direct air capture hubs.

The DOE awarded funding to 21 projects at varying development stages, from feasibility studies to full construction. Two years later, the program faces dismantling. The first cancellation wave in October targeted ten smaller hub awards focused on feasibility and front-end engineering design studies.

A second, unconfirmed list includes seven additional awards, notably Project Cypress in Louisiana and the South Texas DAC Hub, which collectively represented up to $1.2 billion in federal cost share.

Only two awards remain untouched: a $2.5 million grant to General Electric for a Houston-area feasibility study and a $2.9 million grant for Siemens Energy to study a multi-technology hub in the Midwest with a satellite in Berkeley, California. The impact extends beyond immediate project losses. According to Courtni Holness, managing policy advisor at Carbon180, cutting feasibility and design study awards undermines the infrastructure that positioned the U.S. as a competitive player in scaling DAC technology.

"CCS is not aspirational, it is essential. Reaching the scale of carbon management required to safeguard our climate while sustaining the industries that underpin modern life will require all of us to work together and stay the course."

Jarad Daniels, CEO, Global CCS Institute

Global Expansion Defies U.S. Uncertainty

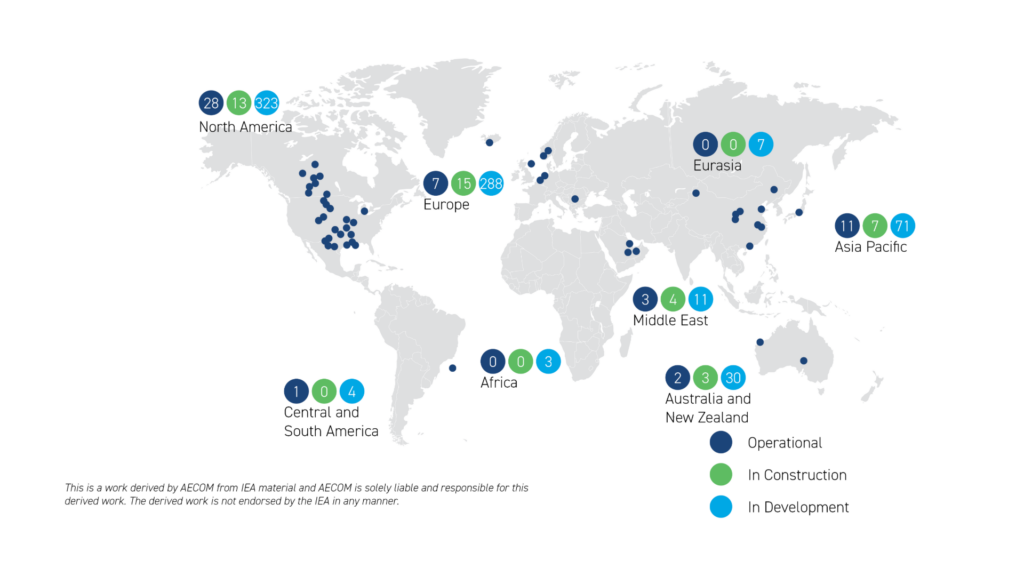

While federal support crumbles in the United States, carbon capture and storage projects are accelerating worldwide. The Global CCS Institute's annual report shows 77 commercial-scale CCS facilities now operating globally, up from 50 in 2024.

An additional 47 projects are under construction, with more than 600 others in early or advanced development stages. Operational CCS projects cumulatively trap approximately 64 million metric tons of carbon dioxide annually, demonstrating that the technology has moved from aspiration to reality.

The growth spans multiple continents and sectors. Norway's Brevik cement plant sold out its entire 2025 production of low-carbon cement within months of opening, proving market demand exists for carbon-reduced products.

In Canada, Prime Minister Mark Carney incorporated carbon removal into his campaign platform, while Deep Sky announced construction of a 500,000-ton capacity facility in Manitoba. The UK secured non-recourse debt financing for large-scale projects like Net Zero Teesside, marking CCS's arrival as a financially mature sector.

>> RELATED: As Policy Changed, CarbonCapture Moved Its Pilot Project From Arizona to Alberta

Regional Momentum by the Numbers

Several regions are establishing themselves as carbon management leaders:

- Europe: 191 projects at various development stages, with five operational and ten under construction. Countries like Denmark and Sweden committed financial support specifically for biogenic CO₂ emissions reduction.

- Asia: Cross-border CCS projects dominate, with Malaysia and Indonesia developing infrastructure to manage domestic emissions and store imported CO₂. Japan, Singapore, and South Korea actively pursue transnational value chains.

- Americas: Despite federal uncertainty, 27 projects operate across the U.S., Brazil, and Canada. State-level initiatives in Texas, Arizona, and West Virginia continue advancing Class VI primacy applications for carbon storage.

"If deployed responsibly alongside deep cuts to new emissions, carbon removal can be a wellspring of new economic and environmental prosperity for communities. Poised to become a trillion-dollar industry, carbon removal could be a rising tide that lifts all boats, creating high-quality jobs, establishing carbon-negative industries, and activating new sources of revenue for US businesses and communities."

Erin Burns, Executive Director, Carbon180

Industry Response: Adaptation and Relocation

The funding uncertainty is forcing companies to make difficult decisions. Carbon Capture Inc. announced it would relocate Project Bison from Arizona to Alberta, Canada, seeking greater regulatory stability.

CEO Adrian Corless told Bloomberg the company decided to move after the first wave of DOE cancellations, choosing not to grapple with ongoing uncertainty even though their project wasn't initially affected. Canada's supportive policy environment and Prime Minister Carney's explicit backing of carbon removal made the northern relocation attractive.

The move highlights broader concerns about U.S. competitiveness in the carbon removal sector. Erin Burns, executive director of Carbon180, noted that state-level reactions will be critical going forward. She pointed specifically to Louisiana and West Virginia, states that have signaled clear interest in hosting carbon removal projects regardless of federal support. However, Burns cautioned that legal ambiguity and regulatory uncertainty in the U.S. make building difficult, regardless of funding availability.

>> In Other News: [x](x)

Market Forces vs. Government Support

The current situation poses a fundamental test: can carbon removal technologies scale through market mechanisms and international drivers without consistent government backing? Private sector commitment remains robust.

Tech giants like Microsoft, Google, and Meta have collectively pledged nearly $1 billion through initiatives like Frontier for carbon removal purchases. These advance market commitments provide demand signals that could sustain development even without federal grants.

The 45Q tax credit for carbon management continues receiving bipartisan Congressional support, suggesting some policy stability persists. State governments are filling gaps left by federal retrenchment.

Texas, Louisiana, and other states are advancing regulatory frameworks to streamline carbon storage permitting, demonstrating that sub-national policy can drive progress. However, experts warn that the scale needed to meet climate targets requires coordinated support across all levels of government and the private sector.

What This Means for North American Competitiveness

The divergence between U.S. federal policy and global expansion creates both risks and opportunities for North American competitiveness. Countries that maintain consistent policy support and regulatory clarity will likely capture more private investment and technological leadership.

Canada's approach, combining carbon pricing mechanisms with direct government support, positions it as an attractive alternative to the U.S. for carbon removal companies. The UK and Norway are similarly leveraging policy stability to attract projects and develop expertise.

For the United States, the challenge extends beyond immediate project cancellations. The uncertainty discourages long-term planning and investment, potentially ceding leadership in a sector projected to become a trillion-dollar industry.

State-level initiatives provide some stability, but coordinated federal support has historically proven critical for scaling emerging technologies. The next few years will reveal whether the combination of private sector commitment, state policy, and remaining federal incentives like 45Q can sustain U.S. competitiveness in carbon management.

Investor confidence hinges on policy predictability. Companies cannot make decades-long infrastructure investments without reasonable certainty about regulatory frameworks and financial incentives.

The current U.S. trajectory risks creating a self-fulfilling prophecy where uncertainty drives projects abroad, which reduces domestic expertise and infrastructure, making future competitiveness even more challenging. However, the robust global growth demonstrates that carbon removal and storage technologies have achieved commercial viability.

The question isn't whether these technologies will scale, but rather which regions will lead their development and reap the associated economic and environmental benefits.

Subscribe to the newsletter

Daily decarbonization data and news delivered to your inbox

Follow the money flow of climate, technology, and energy investments to uncover new opportunities and jobs.

Companies

Latest issues

-

One Montana Site Could Supply Half of North America's SAF

Inside This Issue ✈️ Montana's $1.44B Bet on Aviation Fuel Enters Final Stretch 🌍 Carbon Removal Coalition Forms With Goal of Attracting $100-Million in Project Investments 🤝 Prime Minister Carney...

-

Canada Nickel Just Buried CO₂ Before Mining Even Started

Inside This Issue ⛏️ Canada Nickel And UT Prove Mining Can Fight Climate Change 🛰️ OGCI And Carbon Mapper Team Up To Reduce Methane Emissions From The Oil And Gas Sector 🚛 RNG Continues To Lead As...

-

96% Pure H₂ Found Underground — Now What?

Inside This Issue 🧪 HyTerra's Kansas H₂ Could Power a Historic Industry First 🤝 Prime Minister Carney Secures Ambitious New Partnership With India Focused on Energy, Talent, and Technology Françai...

Company Announcements

-

Carbon Removal Coalition Forms With Goal of Attracting $100-million in Project Investments

Leaders in Canada’s nascent carbon-removal industry have joined with several corporate and financial backers as well as the federal government in a bid to attract $100-million in project investment...

-

New Coalition Targets $100M for Canadian Carbon Removal Projects by 2030

An emerging industry to remove carbon dioxide out of the atmosphere got a boost on Thursday with the launch of an initiative to raise another $100 million for those projects. An emerging industry ...

-

TOKYO, March 6, 2026 /CNW/ - Canada is focused on what we can control – strengthening our economy at home and diversifying our partnerships abroad, including in the Indo-Pacific. Japan is an over $...

-

The Government of Canada, BMO, ClimeFi, NorthX, RBC, Shopify, and Vancity launch the "Advance Carbon Removal Coalition" to advance demand for Canadian CDR. OTTAWA, ON, March 5, 2026 /CNW/ - Canada...